ACTG 1P91 Lecture Notes - Lecture 4: Deferral, Accrual

ACTG 1P91 verified notes

4/26View all

Document Summary

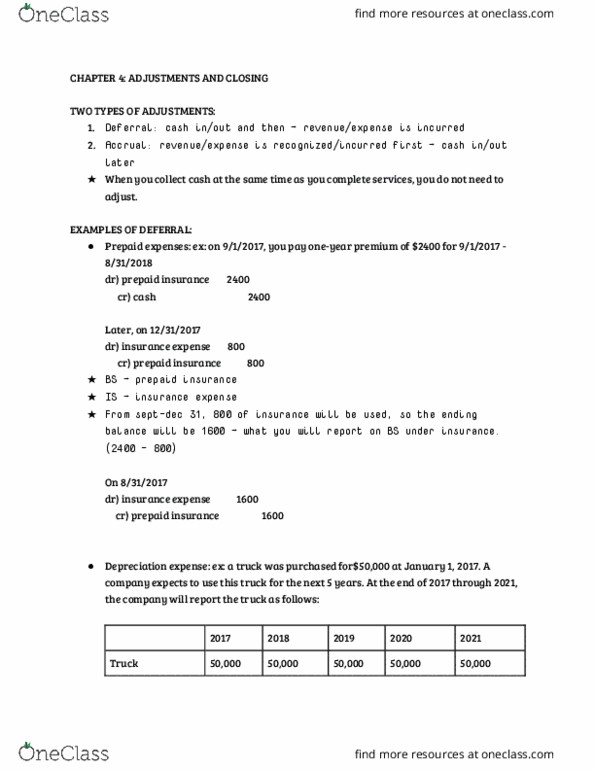

Two types of adjustments: deferral: cash in/out and then revenue/expense is incurred, accrual: revenue/expense is recognized/incurred first cash in/out later. When you collect cash at the same time as you complete services, you do not need to adjust. Prepaid expenses: ex: on 9/1/2017, you pay one-year premium of for 9/1/2017 - 8/31/2018 dr) prepaid insurance 2400 cr) cash 2400. Later, on 12/31/2017 dr) insurance expense 800 cr) prepaid insurance 800. From sept-dec 31, 800 of insurance will be used, so the ending balance will be 1600 what you will report on bs under insurance. (2400 - 800) On 8/31/2017 dr) insurance expense 1600 cr) prepaid insurance 1600. Depreciation expense: ex: a truck was purchased for,000 at january 1, 2017. A company expects to use this truck for the next 5 years. At the end of 2017 through 2021, the company will report the truck as follows: Note that dep. expense and amortization expense can be used interchangeably.