ADM 1340 Lecture 8: ADM 1430 - Lecture 8 - Closing the Books

ADM 1340 verified notes

8/25View all

Document Summary

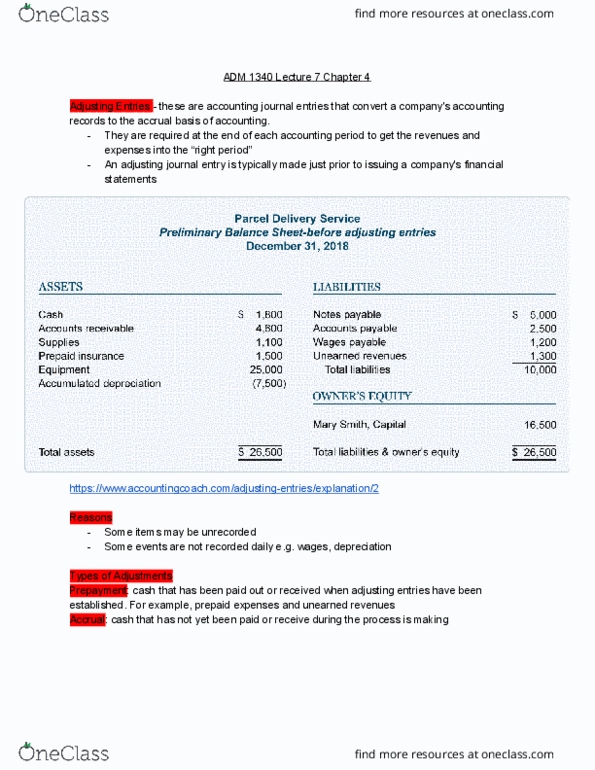

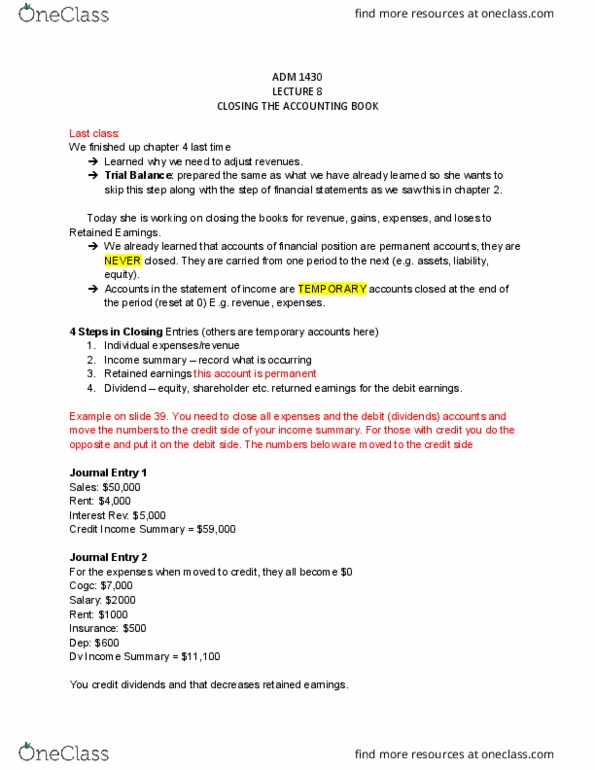

Learned why we need to adjust revenues. Trial balance: prepared the same as what we have already learned so she wants to skip this step along with the step of financial statements as we saw this in chapter 2. Today she is working on closing the books for revenue, gains, expenses, and loses to. We already learned that accounts of financial position are permanent accounts, they are. They are carried from one period to the next (e. g. assets, liability, equity). Accounts in the statement of income are temporary accounts closed at the end of the period (reset at 0) e. g. revenue, expenses. 4 steps in closing entries (others are temporary accounts here: individual expenses/revenue, income summary record what is occurring, retained earnings this account is permanent, dividend equity, shareholder etc. returned earnings for the debit earnings. You need to close all expenses and the debit (dividends) accounts and move the numbers to the credit side of your income summary.