MGAB01H3 Lecture Notes - Lecture 11: Internal Control, Bank Reconciliation, Bank Statement

Document Summary

Get access

Related Documents

Related Questions

Question 14 pts

The five components to a system of internal controls include all of the following except:

| control procedure |

| risk assessment |

| safeguarding assets |

| monitoring controls |

Flag this Question

Question 24 pts

An automobile company testing brakes on new vehicles is part of:

| control procedure |

| risk assessment |

| information systems |

| monitoring controls |

Flag this Question

Question 34 pts

Which account would we debit to open a new petty cash fund?

| cash |

| petty cash |

| miscellaneous expense |

| petty cash expense |

Flag this Question

Question 44 pts

Our company established a petty cash fund with a balance of $200. We have petty cash receipts for travel expenses that total $125. We have counted petty cash and found that we were $2 short. Which of the following would be included in the entry to replenish the fund?

| a credit to petty cash for $127 |

| a debit to travel expenses for $125 |

| a credit to cash over and short for $2 |

| a credit to cash for $125 |

Flag this Question

Question 54 pts

On a bank reconciliation, which of the following will not appear as a deduction on a bank statement?

| deposit |

| NSF check (non-sufficient funds) |

| service charge |

| Payments made by EFT (electronic fund transfer) |

Flag this Question

Question 64 pts

Our company received a bank statement with a balance of $10,000. The reconciling items include outstanding checks that totaled $2,000 and a deposit in transit of $1,000. What is the adjusted bank balance after we complete the bank reconciliation?

| $7,000 |

| $9,000 |

| $11,000 |

| $13,000 |

Flag this Question

Question 74 pts

Our company has decided to write off an uncollectible account of $3,000. What account would we credit to record bad debt expense if our company uses the direct write-off method for bad debts?

| bad debt expense |

| accounts receivable |

| allowance for doubtful accounts |

| cash |

Flag this Question

Question 84 pts

Where does allowance for doubtful accounts appear on our financial statements?

| on balance sheet as a current liability |

| on income statement as part of cost of goods sold |

| on balance sheet as a contra asset related to accounts receivable |

| on the statement of retained earnings as a deduction from net income |

Flag this Question

Question 94 pts

At the end of 2018, we have a credit balance of $10,000 in allowance for doubtful accounts before the adjusting entry for bad debts expense. The company uses the percentage of sales method to estimate bad debt expense. The company estimates that 3% of net credit sales will be uncollectible for the year. Net credit sales for the year amounted to $1,000,000. What account and amount would we debit to record the adjusting entry for bad debt expense?

| bad debt expense, $30,000 |

| allowance for doubtful accounts, $30,000 |

| bad debt expense, $20,000 |

| accounts receivable, $20,000 |

Flag this Question

Question 104 pts

On July 1, 2017, our company accepts a 9-month 5% note for $12,000. What account and amount would we debit when we record the year-end adjusting entry on December 31, 2017?

| interest revenue, $300 |

| interest revenue, $350 |

| interest receivable, $300 |

| interest receivable, $350 |

Financial Accounting, 14th Edition

Carl S. Warren; Jim Reeve; Jonathan Duchac

Final_Multiple choice

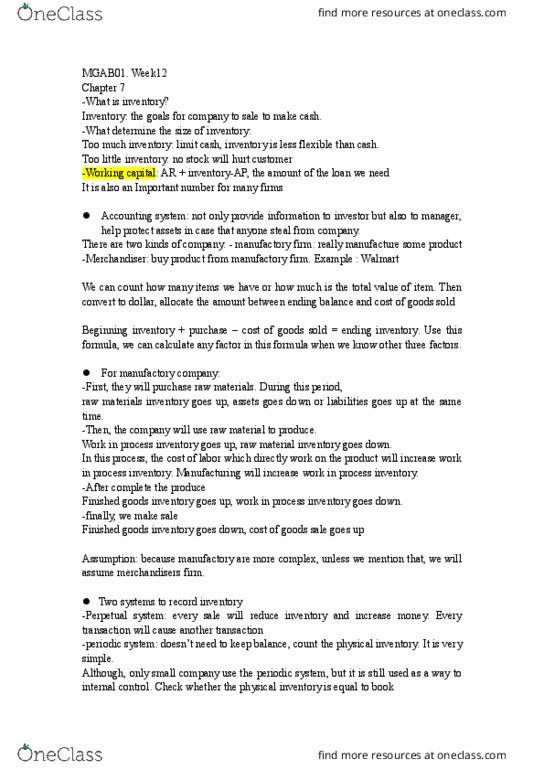

1. The primary objectives of control over inventory are

a.safeguarding the inventory from damage and maintainingconstant observation of the inventory

b.reporting inventory in the financial statements

c.maintaining constant observation of the inventory andreporting inventory in the financial statements

d.safeguarding inventory from damage and reporting inventory inthe financial statements

2. When merchandise sold is assumed to be in the order in whichthe purchases were made, the company is using

a.first-in, last-out

b.first-in, first-out

c.last-in, first-out

d.average cost

3. Use the information below to answer the followingquestion.

The Boxwood Company sells blankets for $60 each. The following wastaken from the inventory records during May. The company had nobeginning inventory on May 1.

| Date | Blankets | Units | Cost |

| May 3 | Purchase | 5 | $20 |

| 10 | Sale | 3 | |

| 17 | Purchase | 10 | $24 |

| 20 | Sale | 6 | |

| 23 | Sale | 3 | |

| 30 | Purchase | 10 | $30 |

Assuming that the company uses the perpetual inventory system,determine the gross profit for the sale of May 23 using the FIFOinventory cost method.

a.$72

b.$108

c.$180

d.$120

4.If merchandise inventory is being valued at cost and thepurchase price is steadily falling, which method of costing willyield the largest net income?

a.FIFO

b.LIFO

c.average cost

d.weighted average

5.Stevens Company started the year with an inventory cost of$145,000. During the month of January, Stevens purchased inventorythat cost $53,000. January sales totaled $140,000. Estimated grossprofit is 35%. The estimated ending inventory as of January 31is

a.$58,000

b.$107,000

c.$69,300

d.$91,000

6. Which one of the following below is not anelement of internal control?

a.risk assessment

b.cost-benefit considerations

c.monitoring

d.information and communication

7. A check drawn by a company for $340 in payment of a liabilitywas recorded in the journal as $430. What entry is required in thecompany's accounts?

a.debit Cash; credit Accounts Receivable

b.debit Accounts Receivable; credit Cash

c.debit Accounts Payable; credit Cash

d.debit Cash; credit Accounts Payable

8. A bank reconciliation should be prepared

a.to explain any difference between the company's balance perbooks with the balance per bank

b.by the company's bank

c.whenever the bank refuses to lend the company money

d.by the person who is authorized to sign checks

9.

Pilger Corporation has cash on hand at year-end of $201,000 anda negative cash flow from operations of $144,000. What is the ratioof cash to monthly cash expenses?

a.1.4 months

b.7.2 months

c.12.0 months

d.16.8 months

10. When does an account become uncollectible?

a.when accounts receivable is converted into notesreceivable

b.when a discount is availed on notes receivable

c.at the end of the fiscal year

d.there is no general rule for when an account becomesuncollectible

11.On the balance sheet, the amount shown for the Allowance forDoubtful Accounts is equal to the

a.total estimated uncollectible accounts as of the end of theyear

b.sum of all accounts that are past due

c.total of the accounts receivables written-off during theyear

d.uncollectible accounts expense for the year

12. Allowance for Doubtful Accounts has a debit balance of $600at the end of the year (before adjustment), and an analysis ofaccounts in the customers ledger indicates uncollectiblereceivables of $13,000. Which of the following entries records theproper adjusting entry for bad debt expense?

a.debit Allowance for Doubtful Accounts, $600; credit Bad DebtExpense, $600

b.debit Bad Debt Expense, $600; credit Allowance for DoubtfulAccounts, $600

c.debit Bad Debt Expense, $13,600; credit Allowance for DoubtfulAccounts, $13,600

d.debit Bad Debt Expense, $12,400; credit Allowance for DoubtfulAccounts, $12,400

13. When comparing the direct write-off method and the allowancemethod of accounting for uncollectible receivables, a majordifference is that the direct write-off method

a.is used primarily by small companies with few receivables

b.is used primarily by large companies with many receivables

c.uses an allowance account

d.uses a percentage of sales method to estimate uncollectibleaccounts

14. Accumulated Depreciation

a. is used to show the amount of cost expiration ofintangibles

b.is used to show the amount of cost expiration of naturalresources

c.is the same as Depreciation Expense

d.is a contra asset account

15. Equipment with a cost of $220,000 has an estimated residualvalue of $30,000 and an estimated life of 10 years or 19,000 hours.It is to be depreciated by the straight-line method. What is theamount of depreciation for the first full year, during which theequipment was used 2,100 hours?

a.$19,000

b.$21,000

c.$30,000

d.$22,000

16. The process of transferring the cost of metal ores and otherminerals removed from the earth to an expense account is called

a.depreciation

b.depletion

c.amortization

d.deferral

17. The Bacon Company acquired new machinery with a price of$15,200 by trading in similar old machinery and paying $12,700. Theold machinery originally cost $9,000 and had accumulateddepreciation of $5,000. In recording this transaction, BaconCompany should record

a.a loss of $1,500

b.the new machinery at $12,700

c.a gain of $1,500

d.the new machinery at $16,700

18. Assuming a 360-day year, when a $50,000, 90-day, 9%interest-bearing note payable matures, total payment will be

a.$54,500

b.$4,500

c.$1,125

d.$51,125

19. Which of the following is required to be withheld fromemployee's gross pay?

a.only federal income tax

b.both federal and state unemployment compensation taxes

c.only state unemployment compensation tax

d.only federal unemployment compensation tax

20. Hall Company sells merchandise with a one-year warranty. Inthe current year, sales consisted of 4,500 units. It is estimatedthat warranty repairs will average $10 per unit sold, and 30% ofthe repairs will be made in the current year and 70% in the nextyear. In the current year's income statement, Hall should showwarranty expense of

a.$45,000

b.$0

c.$13,500

d.$31,500

21. Which of the following below is not acharacteristic of a limited liability company?

a.limited legal liability

b.unlimited life

c.taxable

d.moderate ability to raise capital

22. Seth and Beth have original investments of $50,000 and$100,000 respectively in a partnership. The articles of partnershipinclude the following provisions regarding the division of netincome: interest on original investment at 10%; salary allowancesof $27,000 and $18,000, respectively; and the remainder to bedivided equally. How much of the net income of $42,000 is allocatedto Seth?

a.$20,000

b.$23,000

c.$32,000

d.$0

23. Which of the following is not a rightpossessed by common stockholders of a corporation?

a.the right to share in assets upon liquidation

b.the right to receive a minimum amount of dividends

c.the right to sell their stock to anyone they choose

d.the right to vote in the election of the board ofdirectors

24. The charter of a corporation provides for the issuance of100,000 shares of common stock. Assume that 45,000 shares wereoriginally issued and 5,000 were subsequently reacquired. What isthe amount of cash dividends to be paid if a $2 per share dividendis declared?

a.$80,000

b.$100,00

c.$90,000

d.$10,000

25.Which statement below is not a reason for acorporation to buy back its own stock?

a.to increase the shares outstanding

b.for supporting the market price of the stock

c.resale to employees

d.bonus to employees

Periodic inventory system. Each of the following four horizontal lines represents data taken from a separate multiple-step income statement. Insert the missing amounts in the space (empty box) provided. Indicate any net loss by placing brackets around the amount.

Hint: Not all parts of the income statement are shown, so be careful with your arithmetic.

| Beginning Inventory | Purchases | Cost of Goods Available for Sale | Ending Inventory | Cost of Goods Sold | |

| a. | $180,000 | $325,000 | $80,000 |

| Sales (Revenue) | Cost of Goods Sold | Gross Profit | Operating Expenses | Net Income | |

| b. | $240,000 | $145,000 | $32,000 |

| Revenue (Sales) | Cost of Goods Available for Sale | Ending Inventory | Cost of Goods Sold | Gross Profit | Operating Expenses | Net Income | |

| c. | $515,000 | $240,000 | $145,000 | $225,000 | $145,000 |

. For each question below, circle the best answer from the choices given. (

1 : Under the periodic inventory system the purchases of merchandise are recorded at their selling prices.

a. True b. False

2 : Inventory shrinkage does not include the loss of merchandise through shoplifting.

a. True b. False

3 : Only under the periodic inventory system is a physical count of the inventory necessary.

a. True b. False

4 : It is not possible to have more inventory at the end of a period then at the beginning of a period.

a. True b. False

5) True and false. Indicate whether each of the following is True (T) or False (F). (5 POINTS)

T F 1. US Treasury bills that mature within 120 days are cash equivalents.

T F 2. Financial assets describe not just cash, but all assets that are easily and directly convertible into known amounts of cash.

T F 3. Good cash mgmt. dictates that any cash and checks received each day should be deposited the same day.

T F 4. The income statement approach to estimating Bad debts Expense emphasizes the aging of accounts receivable and the adjustment of the Allowance for Doubtful Accounts account to the level of the estimated uncollectible amount.

T F 5. When I use the allowance method for accounts receivable, I will recognize a Bad Debt Expense at the same time the account is taken off the Accounts Receivable Subsidiary Ledger.

. For each question below, circle the best answer from the choices given.

1. Which of the following items would cause the ending balance on the bank statement to be larger than the ending balance of cash shown in the accounting records (checkbook)?

A) Bank service charges.

B) Deposits in transit.

C) Outstanding checks.

D) NSF check from one of the depositor's customers.

2. When a bank reconciliation has been satisfactorily completed, the only related entries to be made in the companyâs records are:

A) To correct errors made by the bank in recording the dollar amounts of cash transactions during the period.

B) To reconcile items explaining the difference between the balance per books and the balance per bank stmt.

C) To record outstanding checks and bank service charges.

D) To record items explaining the difference between the balance per accounting records and the adj. cash bal.

3. The Allowance for Doubtful Accounts represents:

A) Cash set aside to make up for bad debt losses.

B) The amount of uncollectible accounts written off to date.

C) The difference between total credit sales and collections on credit sales.

D) The difference between the face value of A/R and the net realizable value of A/R.

4. In preparing a bank reconciliation, a service charge shown on the bank statement should be:

A) Added to the balance per the bank statement.

B) Deducted from the balance per the bank statement.

C) Added to the balance per the depositor's records.

D) Deducted from the balance per the depositor's records.

5. During preparation of a bank reconciliation, outstanding checks should be:

A) Added to the balance per the bank statement.

B) Deducted from the balance per the bank statement.

C) Added to the balance per the depositor's records.

D) Deducted from the balance per the depositor's records.

Bank reconciliation. Indicate what effect each situation will have on the bank reconciliation process (Match the situation with the bank reconciliation process below by placing the number of the process next to the situation). Note that there are more situations than processes, so some processes may be used more than once, but not all processes have to be used. Only one process is required for each situation. Hint: Determine if Cash is increasing or decreasing

Process

Deduct from bank balance 2. Add to bank balance

3. Deduct from checkbook balance 4. Add to checkbook balance

Situation

_______ Bank received $2,750 from one of your customers (Terms: Cash in advance)

_______ Bank collection (wire) fee was $15

_______ Check number 111 was outstanding for $55

_______ A $400 check was written, but recorded on the books as $40

_______ Interest received from your bank for the month was $16.55