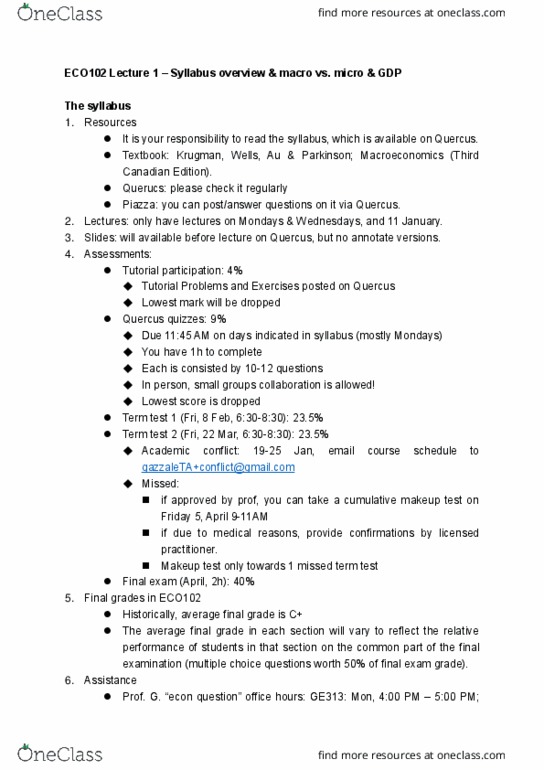

ECO102H1 Lecture Notes - Lecture 26: Fractional-Reserve Banking, Bank Reserves, Reserve Requirement

ECO102H1 verified notes

26/26View all

Document Summary

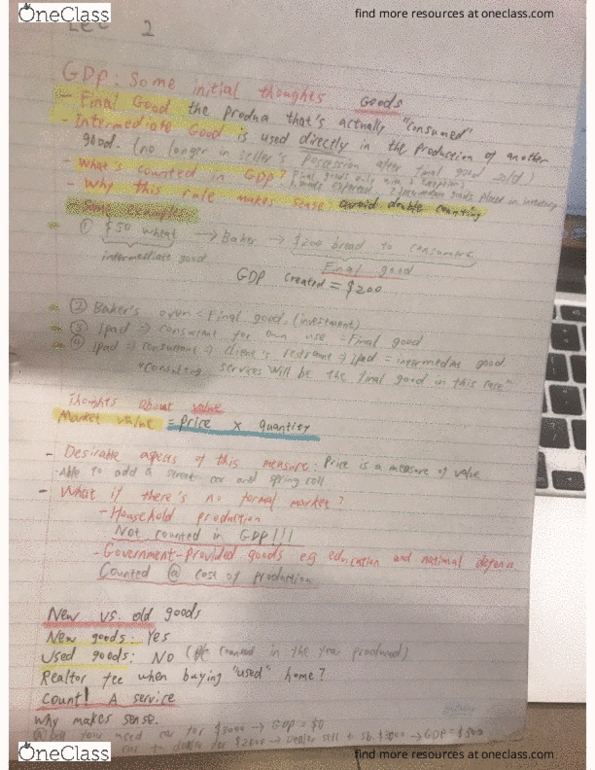

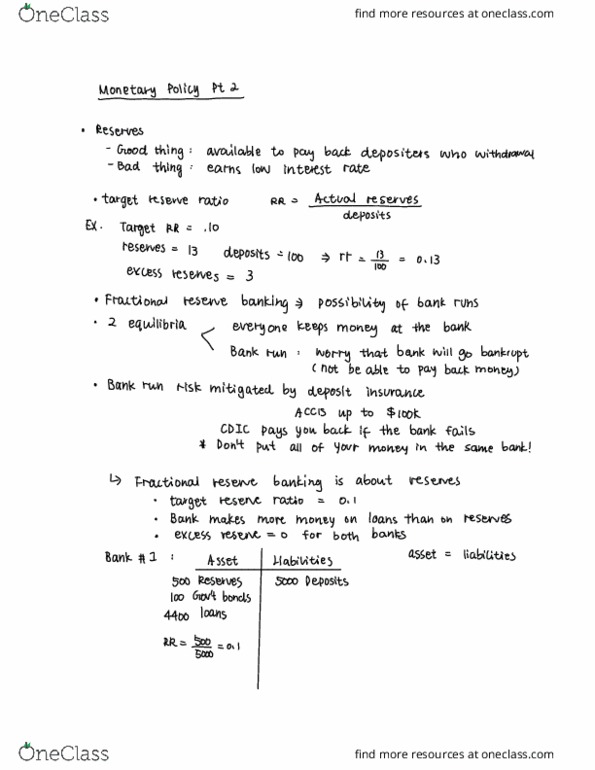

Goodthing i available to pay back depositors who withdrawa. Bad thing earns low interest rate target reserve ratio. Fractional a 2 equilibria reserve banking possibility of bank runs everyone keeps money at the bank. Bank run i worry that bank will go bankrupt not beable to paybackmoney a bank run risk mitigated by deposit insurance. Don"t put all of your money in the same bank. Fractional reserve banking is about reserves e target reserve ratio a bank makes more money on loans than on reserves. Money creation target reserve ratio a bank sells. T 1 immediately after the bond sales target reserves excess reserves. 100 currency target reserves 510 excess reserves. T 3 new loan deposited increase in cheqing account. 81 reserve canmake a 81 loans reserves don"t change if loans are deposited where do we wind up. Not in currency in circulation cash stops moneycreation by decreasing reserves if t money created i currency drain.