In this second section, you are required to read the short case study and answer the required questions:

Kencan Local

In the world of cutting-edge fashion, instinct and marketing knowledge are prerequisites to success. Fanny Elly had both. During 2018, his international formal-ware company, Kencan, rocketed to $300 million in sales after 10 years in business. His fashion line covered middle-aged women from head to toe with hats, dresses, head scarfs and etc. In Kucing, there was a Kencan shop every five or six blocks, each featuring a unique colour.

Kencan had made it. The conservative company’s historical analyst speculated that Encore could not keep up the pace. They warned that competition is intense in the fashion industry and that the firm would experience little or no growth in the future. They estimated that stockholders also should expect no growth in the future dividends.

However, Fanny Elly felt that the company could maintain a constant growth rate in dividends per share of 6% in the future, or possibly 8% for the next 2 years and 6% thereafter. Elly based his estimates on an established long-term expansion plan into the Brunei market. Venturing into these markets was expected to cause the risk of the firm, as measured by the risk premium on its stock, to increase immediately from 8.8% to 10%. Currently, the risk-free rate is 6%.

In preparing the long-term financial plan, Kencan’s chief financial officer has assigned a junior financial analyst, Manny Susan, to evaluate the firm’s current stock price. He has asked Manny to consider the conservative analysis and the aggressive predictions of the company founder, Fanny Elly.

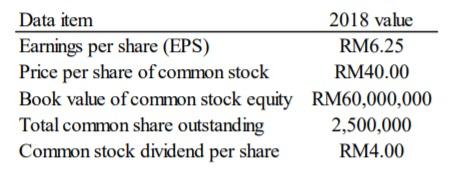

Manny has gathered their 2018 financial data to aid his analysis:

Additionally, Manny has gathered that Kencan holds inventory 70 days, pays its suppliers in 40 days, and collects its receivables in 10 days. The firm has a current annual outlay of RM1,550,000 on operating cycle investments. Kencan currently pays 12 percent for its negotiated financing. Kencan uses 750 units of a product per year on a continuous basis. The product has carrying costs of RM45 per unit per year and order costs of RM280 per order. It takes 15 days to receive a shipment after an order is placed and the firm requires a safety stock of 4 days’ usage in inventory.

Along with that Kencan has been presented with an investment opportunity into Europe which will yield cash flows of RM34,000 per year starting from 2019, Years 1 through 4, RM35,000 per year in Years 5 through 9, and RM45,000 in Year 10. This investment will cost the firm RM130,000 today, and the firm's cost of capital is 9.5 percent with the assumption that the cash flows occur evenly during the year.

Required:

a) Calculate Kencan’s current book value per share (2 marks)

b) Calculate Kencan’s current P/E ratio? (2 marks)

c) Calculate the current required return for Kencan stock? (5 marks)

d) Calculate the new require return for Kencan stock assuming that they expand into the Brunei market as planned? (5 marks)

e) If the security analysts are correct and there is no growth in future dividends, what will be the value per share of Kencan’s stock? (Note: Use the new required return on the company’s stock here.) (5 marks)

f) If Fanny Elly’s predictions are correct, what will the value per share of Kencan stock if the firm maintains a constant annual 6% growth rate in future dividends? (Note: Continue to use the new required return here.) (5 marks)

g) If Fanny Elly’s predictions are correct, what will the value per share of Kencan stock if the firm maintains a constant annual 8% growth rate in future dividends per share over the next 2 years and 6% thereafter? (5 marks)

h) Compare the current (2018) price of the stock and the stock values found in parts a, e, f and g. Discuss why these values differ. Which valuation method do you believe most clearly represents the true value of the Kencan stock? (7 marks)

In this second section, you are required to read the short case study and answer the required questions:

Kencan Local

In the world of cutting-edge fashion, instinct and marketing knowledge are prerequisites to success. Fanny Elly had both. During 2018, his international formal-ware company, Kencan, rocketed to $300 million in sales after 10 years in business. His fashion line covered middle-aged women from head to toe with hats, dresses, head scarfs and etc. In Kucing, there was a Kencan shop every five or six blocks, each featuring a unique colour.

Kencan had made it. The conservative company’s historical analyst speculated that Encore could not keep up the pace. They warned that competition is intense in the fashion industry and that the firm would experience little or no growth in the future. They estimated that stockholders also should expect no growth in the future dividends.

However, Fanny Elly felt that the company could maintain a constant growth rate in dividends per share of 6% in the future, or possibly 8% for the next 2 years and 6% thereafter. Elly based his estimates on an established long-term expansion plan into the Brunei market. Venturing into these markets was expected to cause the risk of the firm, as measured by the risk premium on its stock, to increase immediately from 8.8% to 10%. Currently, the risk-free rate is 6%.

In preparing the long-term financial plan, Kencan’s chief financial officer has assigned a junior financial analyst, Manny Susan, to evaluate the firm’s current stock price. He has asked Manny to consider the conservative analysis and the aggressive predictions of the company founder, Fanny Elly.

Manny has gathered their 2018 financial data to aid his analysis:

Additionally, Manny has gathered that Kencan holds inventory 70 days, pays its suppliers in 40 days, and collects its receivables in 10 days. The firm has a current annual outlay of RM1,550,000 on operating cycle investments. Kencan currently pays 12 percent for its negotiated financing. Kencan uses 750 units of a product per year on a continuous basis. The product has carrying costs of RM45 per unit per year and order costs of RM280 per order. It takes 15 days to receive a shipment after an order is placed and the firm requires a safety stock of 4 days’ usage in inventory.

Along with that Kencan has been presented with an investment opportunity into Europe which will yield cash flows of RM34,000 per year starting from 2019, Years 1 through 4, RM35,000 per year in Years 5 through 9, and RM45,000 in Year 10. This investment will cost the firm RM130,000 today, and the firm's cost of capital is 9.5 percent with the assumption that the cash flows occur evenly during the year.

Required:

a) Calculate Kencan’s current book value per share (2 marks)

b) Calculate Kencan’s current P/E ratio? (2 marks)

c) Calculate the current required return for Kencan stock? (5 marks)

d) Calculate the new require return for Kencan stock assuming that they expand into the Brunei market as planned? (5 marks)

e) If the security analysts are correct and there is no growth in future dividends, what will be the value per share of Kencan’s stock? (Note: Use the new required return on the company’s stock here.) (5 marks)

f) If Fanny Elly’s predictions are correct, what will the value per share of Kencan stock if the firm maintains a constant annual 6% growth rate in future dividends? (Note: Continue to use the new required return here.) (5 marks)

g) If Fanny Elly’s predictions are correct, what will the value per share of Kencan stock if the firm maintains a constant annual 8% growth rate in future dividends per share over the next 2 years and 6% thereafter? (5 marks)

h) Compare the current (2018) price of the stock and the stock values found in parts a, e, f and g. Discuss why these values differ. Which valuation method do you believe most clearly represents the true value of the Kencan stock? (7 marks)