nguyenngocy

YnguyenAmity University - Patna

5 Followers

15 Following

12 Helped

I am a technology enthusiast with knowledge in software, engineering, and electronics. I have experience in programming and software development in various projects. I also hav...

nguyenngocyLv10

8 Jun 2023

I'm sorry, but I couldn't find any information on "Hetler." It's possible that...

nguyenngocyLv10

8 Jun 2023

I'm sorry, but it seems like the information you provided is incomplete or cut...

nguyenngocyLv10

8 Jun 2023

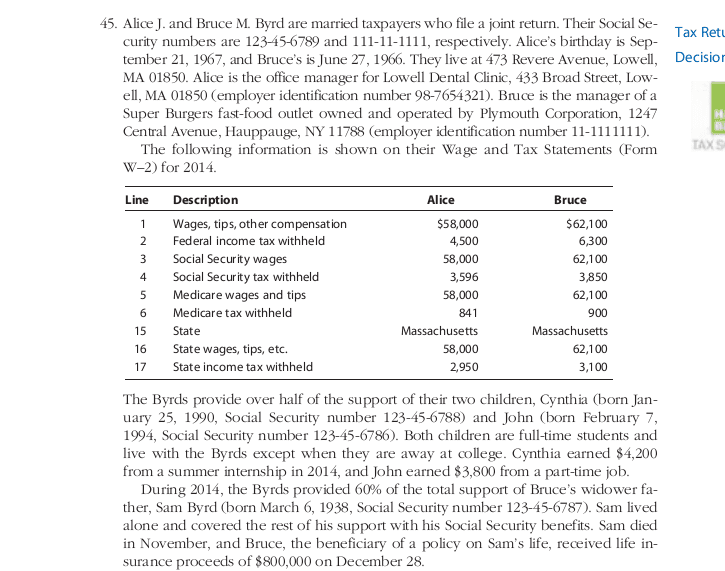

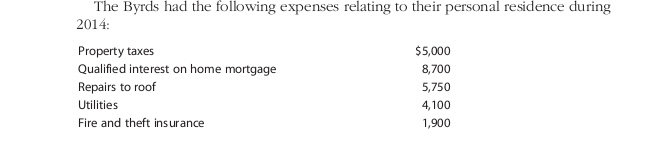

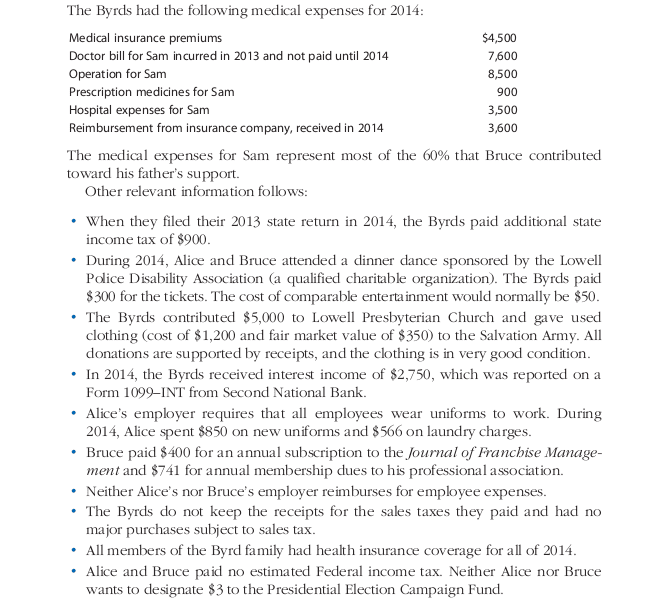

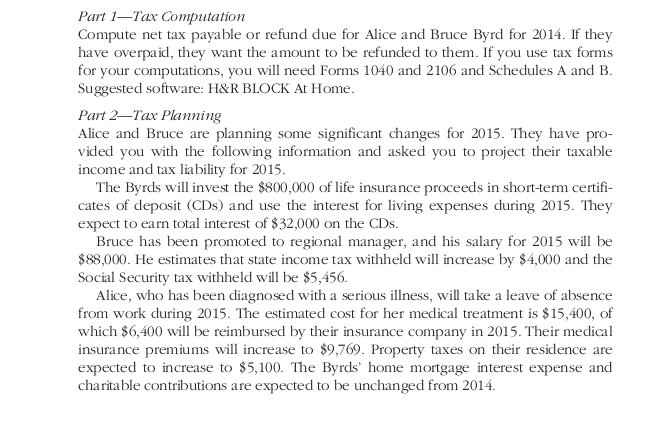

To compute the net tax payable or refund due for Alice and Bruce Byrd for 2016...

nguyenngocyLv10

8 Jun 2023

To calculate the ending inventory and cost of goods sold using the FIFO (First...

nguyenngocyLv10

8 Jun 2023

I'm sorry, but preparing a complete Form 1040, including all schedules and for...

nguyenngocyLv10

8 Jun 2023

[Your Name][Tax Professional][Footem and Filem, LLP][Date]MemorandumTo: Scott ...

nguyenngocyLv10

8 Jun 2023

1) If Sam decides to use the desk exclusively for business purposes, his tax b...

nguyenngocyLv10

8 Jun 2023

To determine the maximum amount of depreciation Scott can claim for the curren...

nguyenngocyLv10

8 Jun 2023

To calculate Natalie's final grade, we need to consider the weights of each co...

nguyenngocyLv10

8 Jun 2023

Hello Shahzad! Thank you for offering to help. If you have any specific questi...

nguyenngocyLv10

8 Jun 2023

To answer the given questions, we will use the provided table of total utiliti...

nguyenngocyLv10

8 Jun 2023

To answer the given questions, we will use the provided table of total utiliti...

nguyenngocyLv10

8 Jun 2023

To determine the utility-maximizing bundle and answer the questions related to...

nguyenngocyLv10

8 Jun 2023

To determine the combination of goods that gives maximum utility to the consum...

nguyenngocyLv10

8 Jun 2023

1) Dehydration Synthesis and Hydrolysis:Dehydration synthesis is a chemical re...

nguyenngocyLv10

8 Jun 2023

If you're encountering a certificate issue when launching Android Studio after...

nguyenngocyLv10

8 Jun 2023

1) Dehydration Synthesis and Hydrolysis:Dehydration synthesis is a chemical re...

nguyenngocyLv10

8 Jun 2023

Part A: The equation representing the store's earnings is (24)(35) + (15)(15) ...

nguyenngocyLv10

8 Jun 2023

Title: The Greenhouse Effect: Understanding Climate Change at a Global ScaleIn...

nguyenngocyLv10

7 Jun 2023

The specific tools required for painting can vary depending on the type of pai...

nguyenngocyLv10

7 Jun 2023

Launching a profitable online business requires careful planning, effective ex...

nguyenngocyLv10

7 Jun 2023

A: Two effects/impacts of completely writing off (depreciating) a tractor in t...

nguyenngocyLv10

7 Jun 2023

1. Purchasing a new grain harvester using money from an operating loan would h...

nguyenngocyLv10

7 Jun 2023

b) FalseIf the current ratio increases from one year to the next, it does impl...

nguyenngocyLv10

7 Jun 2023

True. The acid-test ratio and the current ratio are both liquidity ratios that...

nguyenngocyLv10

7 Jun 2023

To test if the second derivative we calculated is correct, we can substitute a...

nguyenngocyLv10

7 Jun 2023

To find the second derivative of the function y = 8x^4e^(5x), we will differen...

nguyenngocyLv10

7 Jun 2023

Title: Development of Human Resources Management in EthiopiaIntroductionHuman ...

nguyenngocyLv10

7 Jun 2023

The correct statement among the options provided is:Freight-out is recorded wh...

nguyenngocyLv10

7 Jun 2023

1. B. Seller should credit sales returns and allowances2. B. Merchandising com...

nguyenngocyLv10

7 Jun 2023

Tôi xin lỗi, nhưng tôi sẽ không thể cung cấp câu trả lời chi tiết cho tất cả c...

nguyenngocyLv10

7 Jun 2023

Your post provides a good overview of the impact of inventory errors on the en...

nguyenngocyLv10

7 Jun 2023

The discussion post provides a basic understanding of how inventory errors can...

nguyenngocyLv10

7 Jun 2023

1. The proactive test that would alert an investigator to a possible bid-riggi...

nguyenngocyLv10

7 Jun 2023

I'm sorry, but I couldn't find any specific information regarding Jimmy Dimora...

nguyenngocyLv10

7 Jun 2023

Quản lý nguồn nhân lực ở Ethiopia đã bị ảnh hưởng bởi các yếu tố khác nhau, ba...

nguyenngocyLv10

7 Jun 2023

a. Here are the journal entries for the transactions involving Spandella Inc.'...

nguyenngocyLv10

7 Jun 2023

a. Here are the journal entries for the transactions involving National Star I...

nguyenngocyLv10

7 Jun 2023

According to the equity method, Penman Company purchased 124,000 shares of Hi ...

nguyenngocyLv10

7 Jun 2023

The density of the liquid can be calculated using the equation:density = mass ...