ECON 1 Lecture 14: Tax Incidence

ECON 1 verified notes

14/31View all

Document Summary

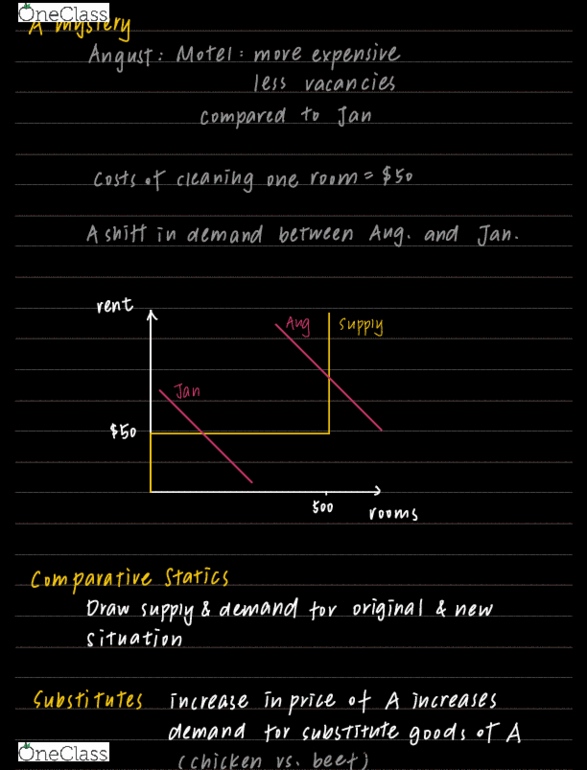

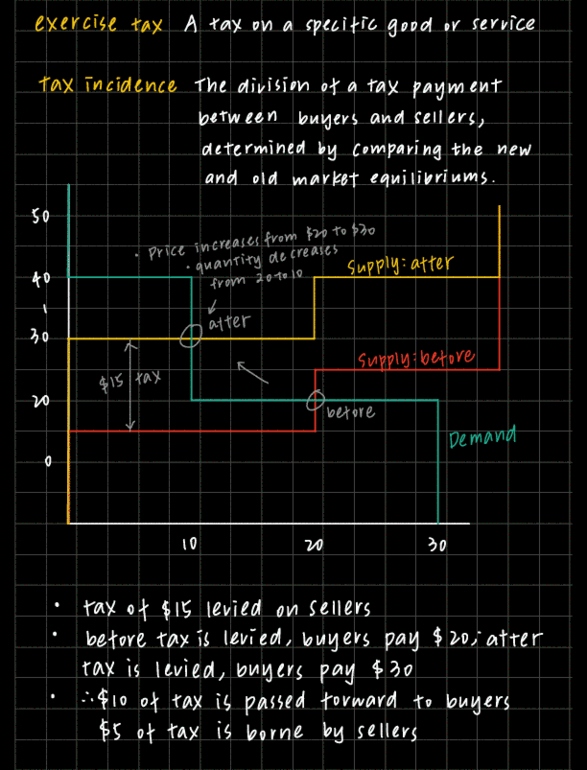

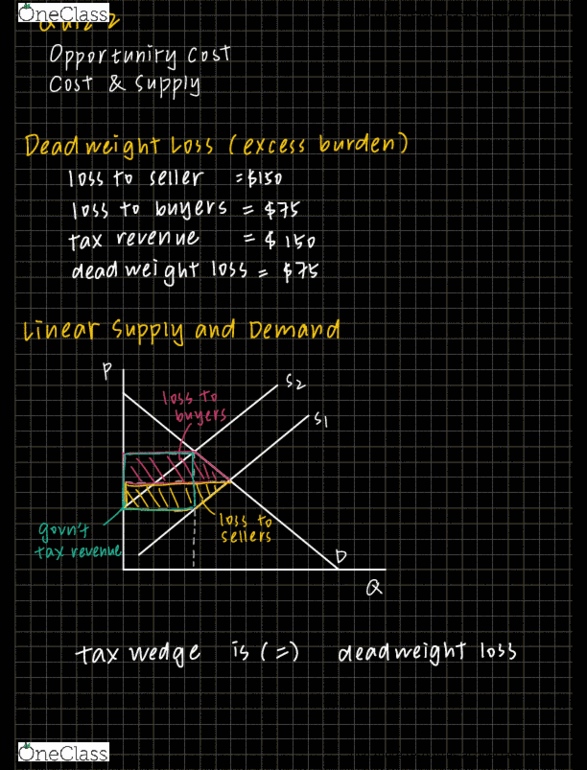

Exercise tax a tax on a specific good or service tax incidence. The division of a tax payment buyers and sellers between determined by comparing the and old market equilibrium s new. A l5 tax v price increasesfrom 20 to 30 quantity decrease supply after from 20. 15 levied on sellers tax of before tax is levied tax is levied i buyers pay. 5 of tax is passed forward to buyers tax is borne by sellers. Tax on sellers tax on buyers price to buyers net price to sellers. 30 15 415 tax tax on sellers net price to buyers. 15 115 430 tax linear supply and demand after before price buyers price before tax. Perfectly inelastic supply tool of tax is paid by sellers. 1 sellers price taxid quantity difference in must be equal sellers to the and buyers price amount of tax. Ps price seller t of amount tax receive. Ps t t e g pd 200 0. 79.