ECON 2 Lecture Notes - Lecture 14: John Maynard Keynes, Ricardian Equivalence, Potential Output

ECON 2 verified notes

14/19View all

Document Summary

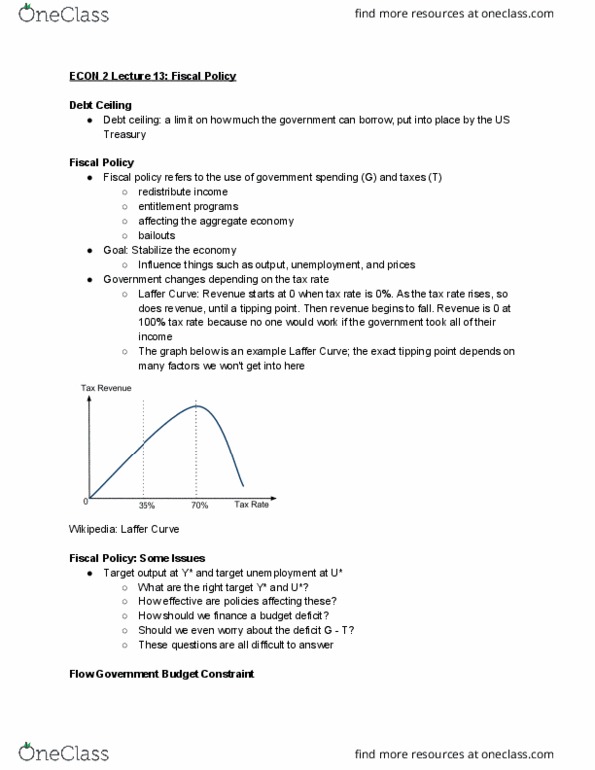

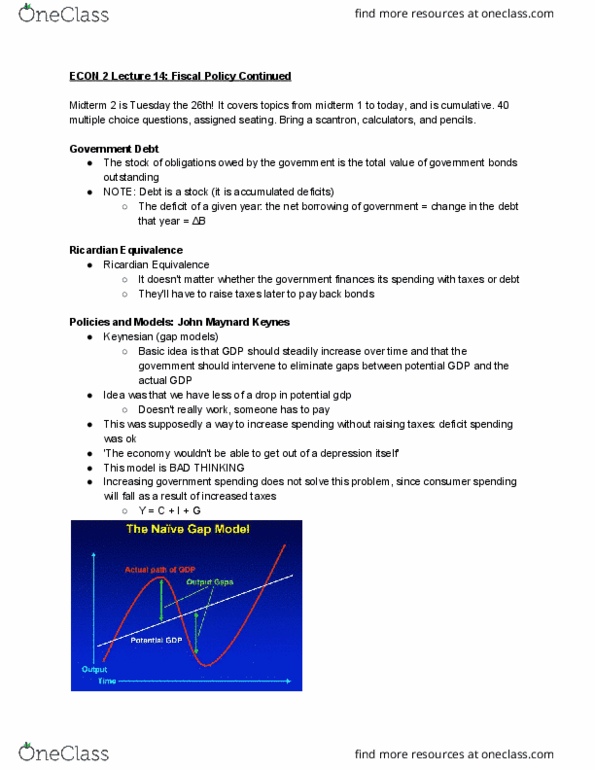

It covers topics from midterm 1 to today, and is cumulative. The stock of obligations owed by the government is the total value of government bonds outstanding. Note: debt is a stock (it is accumulated deficits) The deficit of a given year: the net borrowing of government = change in the debt that year = b. It doesn"t matter whether the government finances its spending with taxes or debt. They"ll have to raise taxes later to pay back bonds. Basic idea is that gdp should steadily increase over time and that the government should intervene to eliminate gaps between potential gdp and the actual gdp. Idea was that we have less of a drop in potential gdp. Doesn"t really work, someone has to pay. This was supposedly a way to increase spending without raising taxes: deficit spending was ok. "the economy wouldn"t be able to get out of a depression itself"