ACCT3321 Lecture Notes - Lecture 11: Cash Flow Hedge, Credit Risk, Book Value

CHAPTER 23

Foreign currency transactions and forward exchange contracts

-Functional currency

oIs the currency of the primary economic environment in which the company

operates [the one in which the company primarily generates and expends

cash

-Types of foreign currency transactions

oA transaction that is denominated or requires settlement in a foreign

currency

oAny currency other than the company’s functional currency

EXCHANGE RATES

- The ratio of exchange for two currencies

-Spot exchange rate the exchange rate for immediate delivery at a particular point

in time whereas the closing rate is the spot exchange rate at the end of the reporting

period

INITIAL MEASUREMENT AT THE TRANSACTION DATE

- Which exchange rates should be used to translate the foreign currency balances?

- The financial statement item that arise from a foreign currency transaction should be

measured on initial recognition using the historical exchange rate at the date of

transaction

- The acquisition or disposal of an asset – the date of the transaction depends on

when control of the future economic benefits embodied in the asset are obtained

from or transferred to another entity

- DR Purchase thing CR payable to foreign supplier (initial recognition)

MONETARY AND NON-MONETARY ITEMS

- Monetary – units of currency held and assets and liabilities to be received or paid in

a fixed or determinable amount of currency

oRefers to cash or another item that constitutes a claim to cash or an

obligation to pay cash

oShares held in ASX = financial asset but the shares do not constitute a

monetary item

- Non-monetary item – an asset or liability that is not a monetary item – inventory and

PPE

FOREIGN EXCHANGE DIFFERENCES FOR MONETARY ITEMS

- The difference resulting from translating a given number of units of one currency

into another currency at difference exchange rates

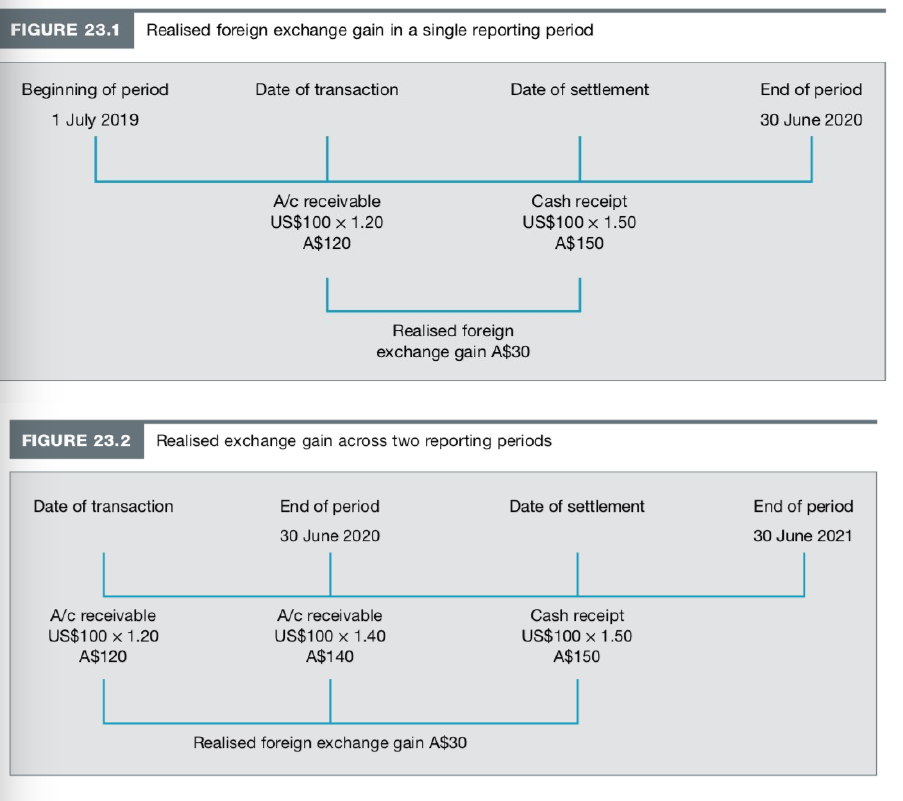

-Realised and unrealised gains or losses from exchange differences

oWhen there are differences in the exchange rate and you win out

find more resources at oneclass.com

find more resources at oneclass.com

oWhen it occurs in more than one period – should the unrealised exchange

gain or losses be recognised?

oThere is a requirement that exchange gains and losses be immediately

recognised in the P&L as they arise

-The relationship between exchange rates and exchange differences

oExample p 10 – 11

oIf the change in exchange rate shows that the foreign currency increases in

value relative to the functional currency:

A monetary asset denominated in foreign currency will increase when

translated into the less valuable functional currency giving rise to a

gain as the company is effectively entitles to receive more units of

functional currency

A monetary liability denominated in foreign currency will increase

when translated into the less valuable functional currency giving rise

to a foreign exchange loss as the company is effectively asked to pay

more units of functional currency

oIf the change in the exchange rate shows that the foreign currency decreases

in value relative to the functional currency

find more resources at oneclass.com

find more resources at oneclass.com

Document Summary

Functional currency: is the currency of the primary economic environment in which the company operates [the one in which the company primarily generates and expends cash. Types of foreign currency transactions: a transaction that is denominated or requires settlement in a foreign currency, any currency other than the company"s functional currency. Spot exchange rate the exchange rate for immediate delivery at a particular point in time whereas the closing rate is the spot exchange rate at the end of the reporting period. The financial statement item that arise from a foreign currency transaction should be measured on initial recognition using the historical exchange rate at the date of transaction. The acquisition or disposal of an asset the date of the transaction depends on when control of the future economic benefits embodied in the asset are obtained from or transferred to another entity. Dr purchase thing cr payable to foreign supplier (initial recognition)