ECON 2002.01 Lecture Notes - Lecture 21: Federal Funds Rate, Dual Mandate, United States Treasury Security

ECON 2002.01 verified notes

21/29View all

18

ECON 2002.01 Lecture Notes - Lecture 18: Fractional-Reserve Banking, Excess Reserves, Reserve Requirement

21

ECON 2002.01 Lecture Notes - Lecture 21: Federal Funds Rate, Dual Mandate, United States Treasury Security

23

ECON 2002.01 Lecture Notes - Lecture 23: Federal Open Market Committee, Open Market Operation, Money Supply

Document Summary

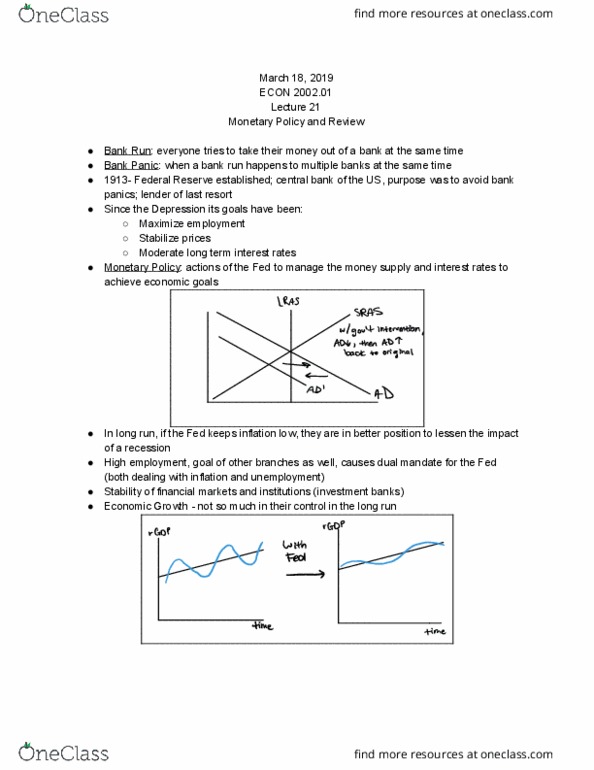

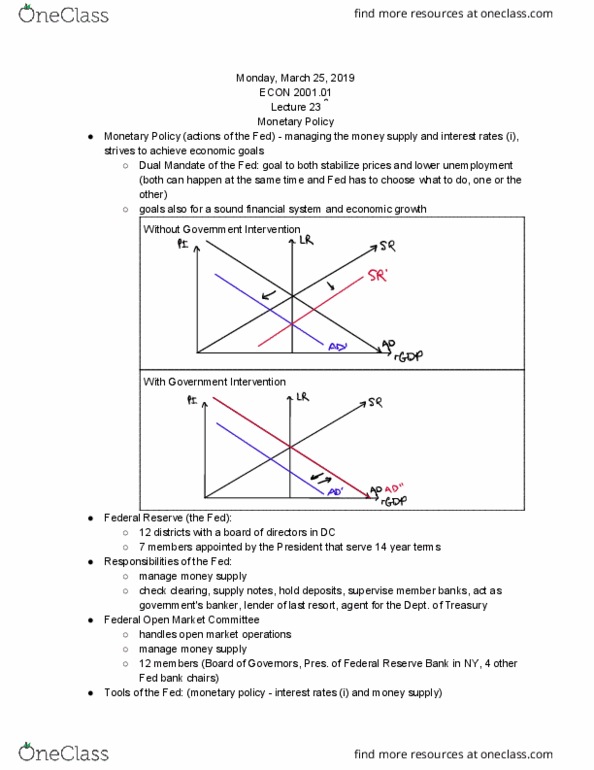

Bank run : everyone tries to take their money out of a bank at the same time. Bank panic : when a bank run happens to multiple banks at the same time. 1913- federal reserve established; central bank of the us, purpose was to avoid bank panics; lender of last resort. Since the depression its goals have been: Monetary policy : actions of the fed to manage the money supply and interest rates to achieve economic goals. In long run, if the fed keeps inflation low, they are in better position to lessen the impact of a recession. High employment, goal of other branches as well, causes dual mandate for the fed (both dealing with inflation and unemployment) Stability of financial markets and institutions (investment banks) Economic growth - not so much in their control in the long run rgdp. Open market operations (buying/selling of treasury securities) Buying is an expansionary policy, ad increases.