MGMT 30A Lecture Notes - Lecture 14: Record Plant, Natural Resource, Financial Statement

MGMT 30A verified notes

14/21View all

Document Summary

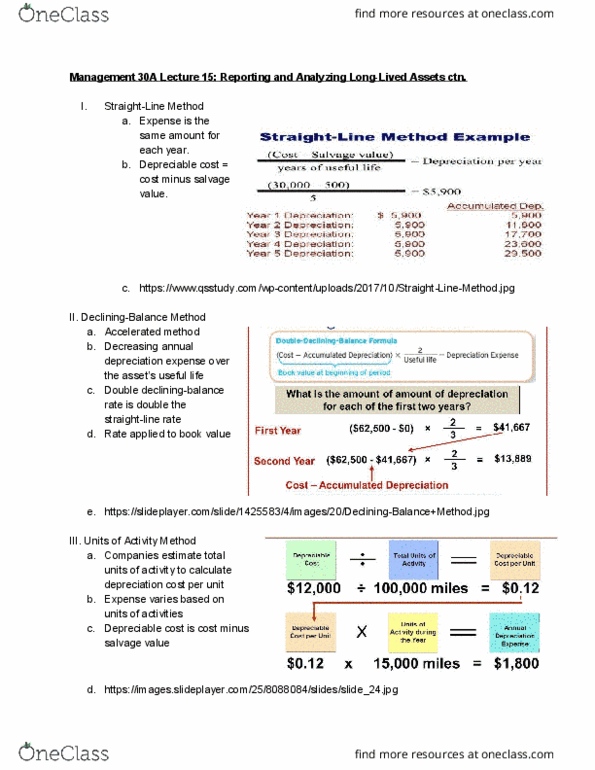

Management 30a lecture 14: reporting & analyzing long-lived assets. Classifying long-lived assets: long-lived assets are actively used in operations . (having physical substance) or future periods intangible . (having no physical substance): examples of tangible assets include: Assets subject to depreciation like buildings and equipment or furniture and fixtures. Natural resource assets subject to depletion like mineral deposits and timber: examples of intangible assets include: Value represented by rights that produce benefits. Subject to amortization (ex: patents, copyrights, trademarks, franchises) Acquisition cost: the historical cost principle , cost consists of all expenditures necessary to acquire an asset and make it ready for its. Requires that companies record plant assets at cost. intended use. immediately: revenue expenditure , capital expenditures , cost paid, cash equivalent price . : costs incurred to acquire a plant asset that are expensed. : costs included in a plant asset account. Is measured by the cash paid in a cash transaction or the cash equivalent price.