BUS 320 Lecture 12: Chapter 12

Chapter 12: Cash Flow Estimation and Risk Analysis

Proposed Project

Determining Project Value

Initial Year Investment Outlays

•Total depreciable cost

–Equipment: $200,000

–Shipping and installation: $40,000

•Changes in net operating working capital

–Inventories will rise by $25,000

–Accounts payable will rise by $5,000

•Effect on operations

–New sales: 100,000 units/year @ $2/unit

–Variable cost: 60% of sales

•Life of the project

–Economic life: 4 years

–Depreciable life: MACRS 3-year class

–Salvage value: $25,000

•Tax rate: 40%

•WACC: 10%

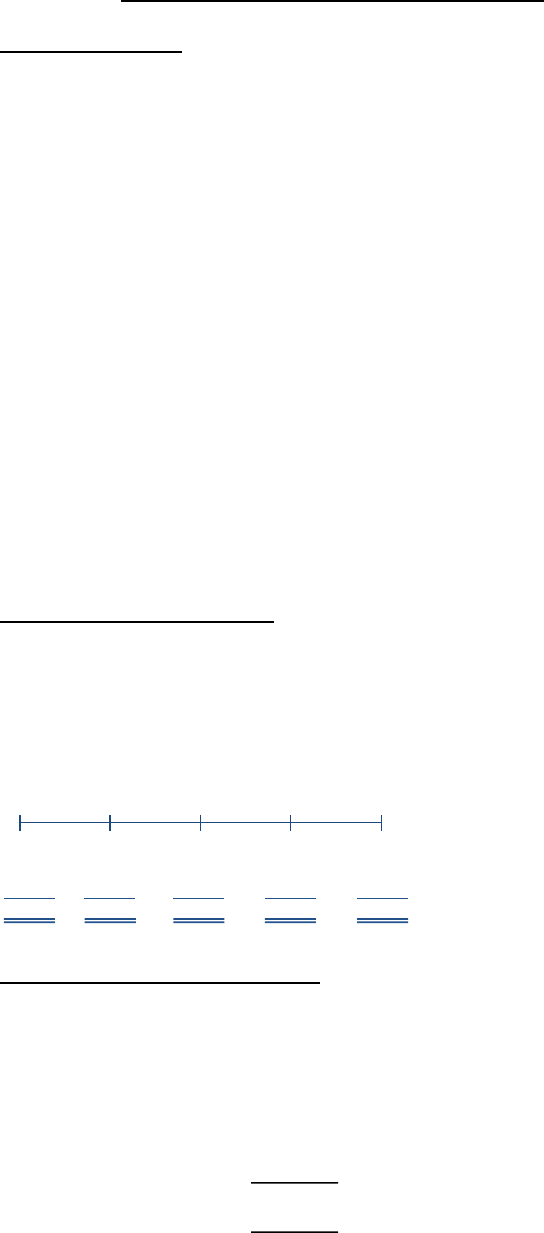

•Estimate relevant cash flows

–Calculating annual operating cash flows.

–Identifying changes in net operating working

capital.

–Calculating terminal cash flows: after-tax

salvage value and recovery of NOWC.

Initial OCF1OCF2OCF3OCF4

Costs +

Terminal

CFs

FCF0FCF1FCF2FCF3FCF4

0 1 2 3 4

•Find DNOWC.

–áin inventories of $25,000

–Funded partly by an áin A/P of $5,000

–DNOWC = $25,000 –$5,000 = $20,000

•Initial year outlays:

Equipment cost -$200,000

Installation -40,000

CAPEX -240,000

DNOWC -20,000

FCF0-$260,000

find more resources at oneclass.com

find more resources at oneclass.com

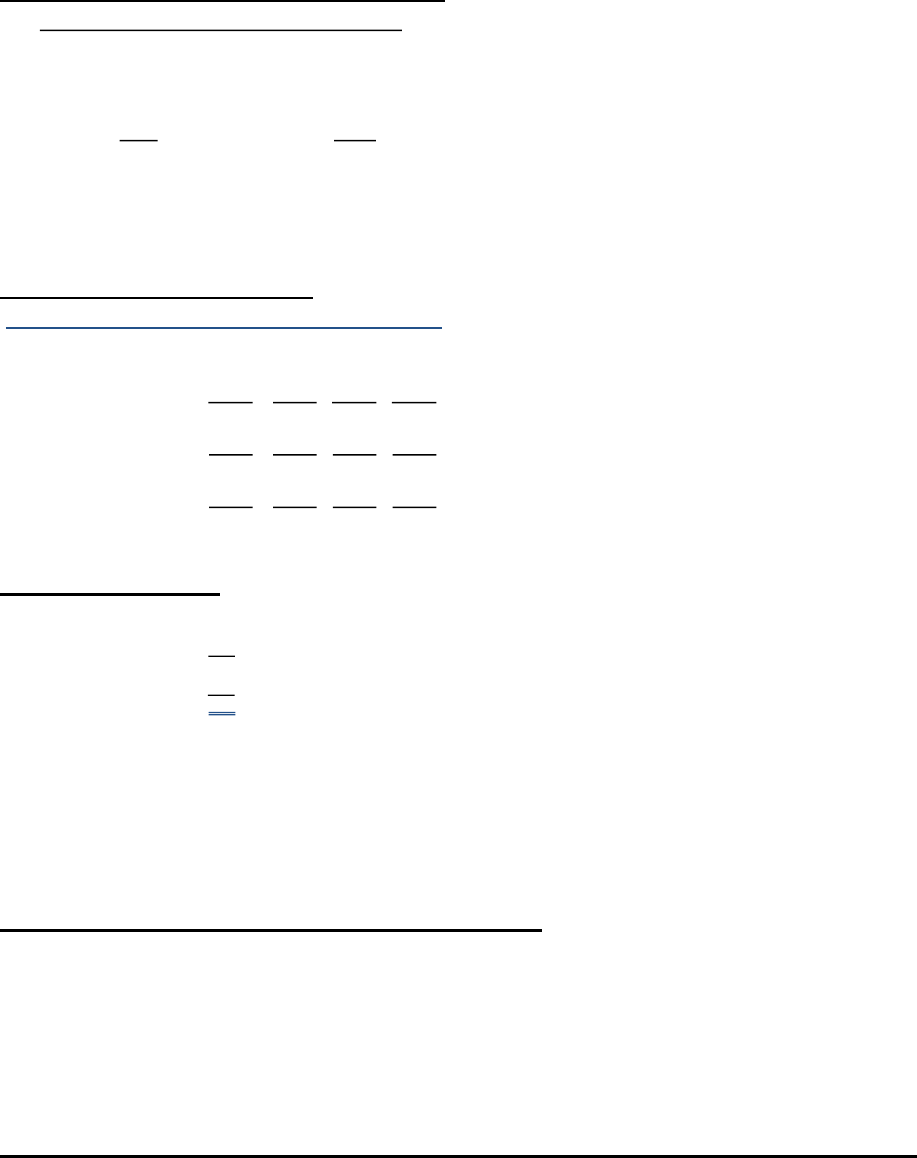

Determining Annual Depreciation Expense

Project Operating Cash Flows

Terminal Cash Flows

• How is NOWC recovered?

• Is there always tax on salvage value?

• Is the tax on salvage value ever a positive cash flow?

Should financing effects be included in cash flows?

Should a $50,000 improvement cost from the previous year be included in the analysis?

Year Rate x Basis Deprec.

1 0.33 x $240 $ 79

2 0.45 x 240 108

3 0.15 x 240 36

4 0.07 x 240 17

1.00 $240

Due to the MACRS ½-year convention, a 3-year

asset is depreciated over 4 years.

(Thousands of dollars) 1 2 3 4

Revenues 200.0 200.0 200.0 200.0

–Op. costs -120.0 -120.0 -120.0 -120.0

–Deprec. expense -79.2 -108.0 -36.0 -16.8

EBIT 0.8 -28.0 44.0 63.2

–Tax (40%) 0.3 -11.2 17.6 25.3

EBIT(1 –T) 0.5 -16.8 26.4 37.9

+ Depreciation 79.2 108.0 36.0 16.8

EBIT(1 –T) + DEP 79.7 91.2 62.4 54.7

Salvage value $25

-Tax on SV (40%) 10

AT salvage value $15

+ DNOWC

Terminal CF $35

20

(Thousands of dollars)

FCF4= EBIT(1 –T) + DEP –CAPEX –DNOWC

= $54.7 + $35

= $89.7

•No, dividends and interest expense should not

be included in the analysis.

•Financing effects have already been taken into

account by discounting cash flows at the

WACC of 10%.

•Deducting interest expense and dividends

would be “double counting” financing costs.

•No, the building improvement cost is a sunk

cost and should not be considered.

•This analysis should only include incremental

investment.

find more resources at oneclass.com

find more resources at oneclass.com

Document Summary

Chapter 12: cash flow estimation and risk analysis. Shipping and installation: ,000: changes in net operating working capital. Accounts payable will rise by ,000: effect on operations. Variable cost: 60% of sales: life of the project. Salvage value: ,000: tax rate: 40, wacc: 10% Determining project value: estimate relevant cash flows. Calculating terminal cash flows: after-tax capital. salvage value and recovery of nowc. Initial year investment outlays: find d nowc. Funded partly by an in a/p of ,000. D nowc = ,000 ,000 = ,000: initial year outlays: Due to the macrs -year convention, a 3-year asset is depreciated over 4 years. Fcf4 = ebit(1 t) + dep capex d nowc. Should financing effects be included in cash flows: no, dividends and interest expense should not, financing effects have already been taken into be included in the analysis. account by discounting cash flows at the. Wacc of 10%: deducting interest expense and dividends would be double counting financing costs.