ECON 102 Lecture Notes - Lecture 18: Canada Deposit Insurance Corporation, Overnight Rate, Reserve Requirement

ECON 102 verified notes

18/40View all

Document Summary

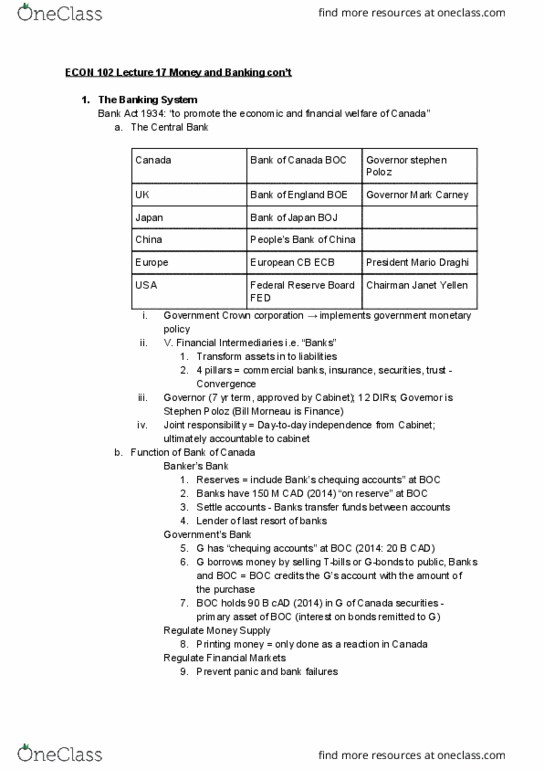

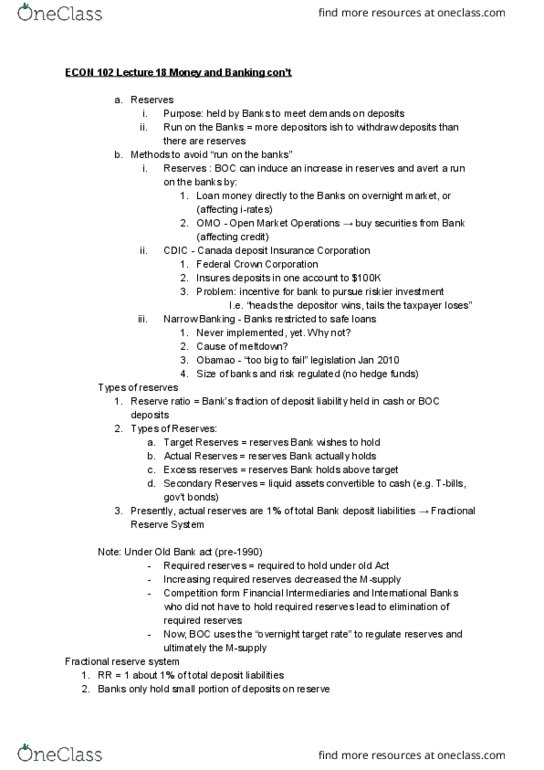

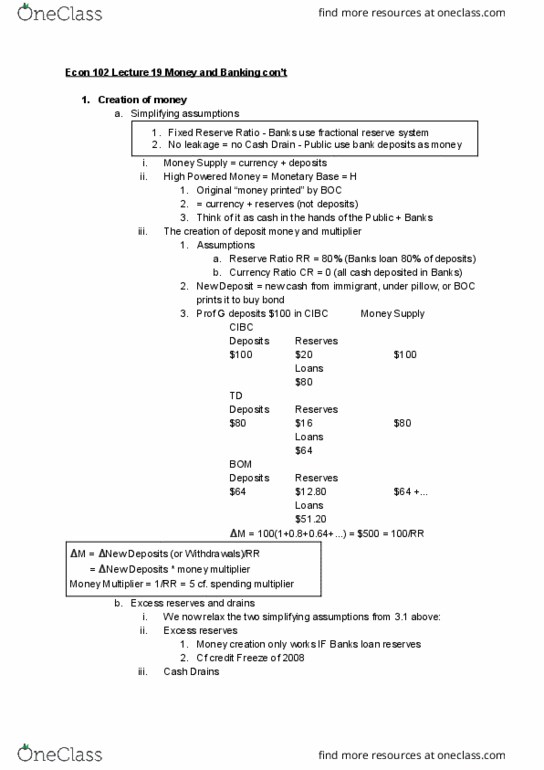

Econ 102 lecture 18 money and banking con"t: reserves i. ii. Purpose: held by banks to meet demands on deposits. Run on the banks = more depositors ish to withdraw deposits than there are reserves: methods to avoid run on the banks i. Cdic - canada deposit insurance corporation: federal crown corporation. 2: problem: incentive for bank to pursue riskier investment. Heads the depositor wins, tails the taxpayer loses iii. Narrow banking - banks restricted to safe loans: never implemented, yet. Why not: cause of meltdown, obamao - too big to fail legislation jan 2010, size of banks and risk regulated (no hedge funds) Required reserves = required to hold under old act. Competition form financial intermediaries and international banks. Increasing required reserves decreased the m-supply who did not have to hold required reserves lead to elimination of required reserves. Now, boc uses the overnight target rate to regulate reserves and ultimately the m-supply.