ECON 2010 Lecture Notes - Lecture 16: Luxury Goods, Tax Rate, Economic Surplus

ECON 2010 verified notes

16/47View all

Document Summary

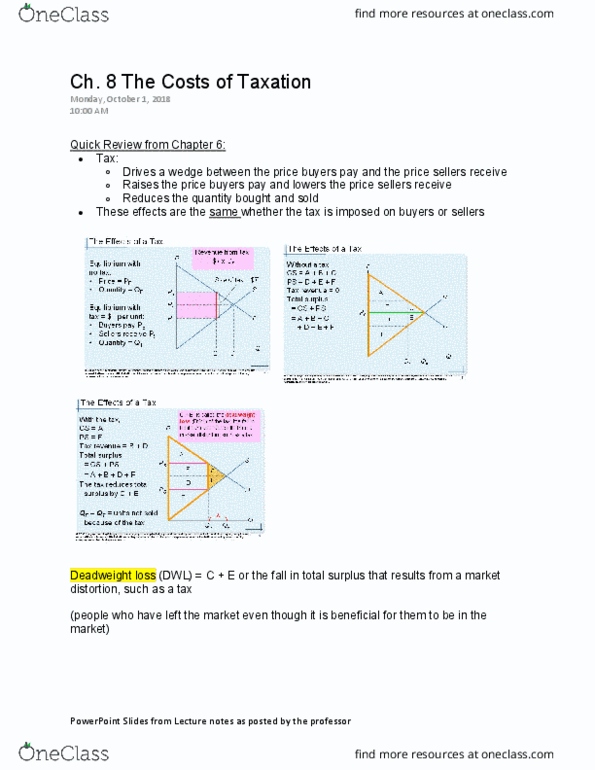

Powerpoint slides from lecture notes as posted by the professor (assume for this example that the intersection of the d curve on the p axis is at 400 and that the equilibrium--point where the lines cross--is at 100, 200) Dwl: loss of beneficial exchanges when people leave the market. Answers: breakfast cereal (more substitutes higher elasticity larger. Dwl) larger dwl: restaurant meals (luxury good. A tax on groceries would be more efficient (smaller dwl) than a tax on restaurant meals. However, a tax on groceries would hurt people with low incomes proportionately more than people with higher incomes, as the former spend a larger percentage of their income on groceries. Effects of changing the size of the tax: as the tax increases, deadweight loss increases even more rapidly than the size of the tax, tax revenue. Powerpoint slides from lecture notes as posted by the professor.