ECON 1202 Lecture Notes - Lecture 11: Business Cycle, Loanable Funds, United States Treasury Security

ECON 1202 verified notes

11/29View all

Document Summary

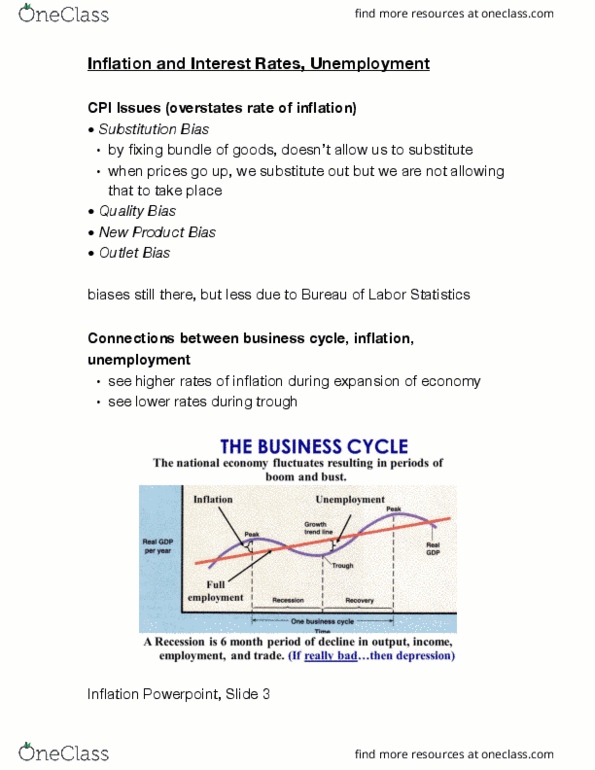

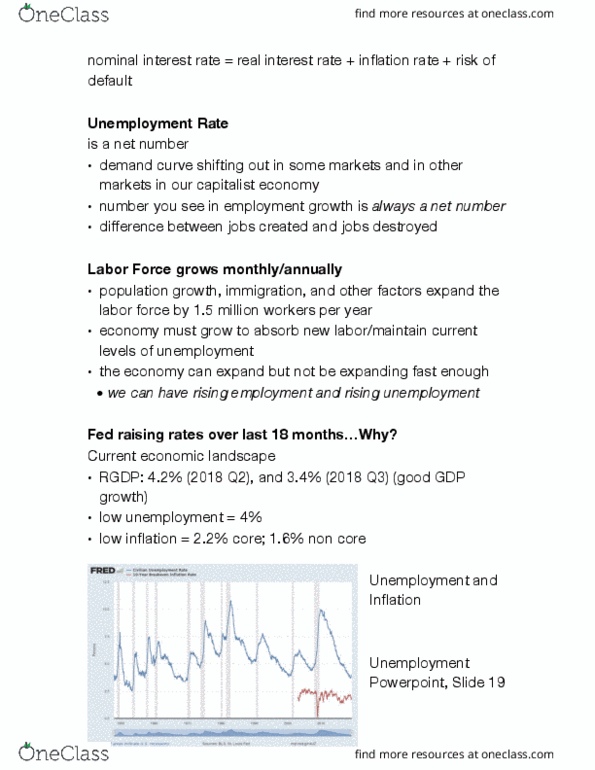

Connections between business cycle, in ation, unemployment: see higher rates of in ation during expansion of economy, see lower rates during trough. Nominal rate: what lenders actually get paid, what borrowers actually pay in nominal or money terms, stated rate of interest. *higher rates of in ation -> higher interest rates. Nominal interest rate (i) = real interest rate + in ation rate or. Real interest rate = nominal interest rate (i) - in ation rate . Real rate of interest: the real (after adjusting for in ation) returns lenders receive from lending, the real (after adjusting for in ation) cost to borrowers from borrowing, determine in the nancial markets/bond market (loanable funds market) Another factor that determines rate of interest is risk of default. Nominal rate of interest deconstructed i = real interest rate + in ation rate + risk of default (b)