Reedyâs International

In the world of Archery knowledge, customer service and attention to detail are prerequisites to success. Mathew Reedy had it all. During 2015, his local Archery sales, service, instruction and excursion company, Reedyâs, rocketed to $100 million in sales after 21 years in business. His company gave the archery community a place to go to get fitted for just the right bow for that fresh venison, turkey, elk and even wild boar.

Reedyâs had made it. The companyâs historical growth was so spectacular that no one could have predicted it. However, securities analysts speculated that Reedyâs could not keep up the pace. They warned that competition is fierce in the archery and hunting retail sales industry and that the firm might encounter little or no growth in the future. They estimated that stockholders also should expect no growth in future dividends.

Contrary to the conservative securities analysts, Mathew Reedy feels that the company could maintain a constant annual growth rate in dividends per share of 9.5% in the future, or possibly 13% for the next 2 years and 9.5% thereafter. Reedy based his estimates on an established long-term expansion plan into other states, Canadian and Mexican markets. Venturing into these markets was expected to cause the risk of the firm, as measured by the beta on its stock, to increase immediately from 1.1 to 1.5.

In preparing the long-term financial plan, Reedyâs chief financial officer, Eric Disbrow, has assigned a junior financial analyst, Chris Reed, to evaluate the firmâs current stock price. He has asked Chris to consider the conservative predictions of the securities analysts and the aggressive predictions of the company founder, Mathew Reedy.

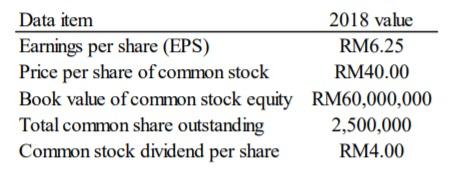

Eric has compiled the 2015 financial data to aid his analysis:

Data item

2015 value

Earnings per share (EPS)

$4.13

Price per share of common stock

$39.00

Book value of common stock equity

$6,000,000

Total common shares outstanding

300,000

Common stock dividend per share

$2.05

Data Points

Beta, b

Required Return, K

0

4.5%

.25

6.75%

.5

9%

.75

11.25%

1

13.5%

1.25

15.75%

1.5

18%

To Do

a. What is the firmâs current book value per share?

b. What is the firmâs current P/E ratio?

c. (1) What is the current required return for Reedy stock (use CAPM)?

(2) What will be the new required return for Reedy stock assuming that they expand into Canadian, Mexican and other state markets as planned (use CAPM)?

d. If the securities analysts are correct and there is no growth in future dividends, what will be the value per share of the Reedy stock? (Note: use the new required return on the companyâs stock here)

e. (1) If Mathew Reedyâs predictions are correct, what will be the value per share of Reedyâs stock if the firm maintains a constant annual 9.5% growth rate in future dividends? (Note: Continue to use the new required return here.)

(2) If Mathew Reedyâs predictions are correct, what will be the value per share of Reedyâs stock if the firm maintains a constant annual 13% growth rate in dividends per share over the next 2 years and 9.5% thereafter? (Note: Use the new required return here.)

f. Compare the current (2016) price of the stock and the stock values found in parts a, d, and e. Discuss why these values may differ. Which valuation method do you believe most clearly represents the true value of the Reedyâs stock?

PLEASE SHOW ALL WORK. THANK YOU.

Reedyâs International

In the world of Archery knowledge, customer service and attention to detail are prerequisites to success. Mathew Reedy had it all. During 2015, his local Archery sales, service, instruction and excursion company, Reedyâs, rocketed to $100 million in sales after 21 years in business. His company gave the archery community a place to go to get fitted for just the right bow for that fresh venison, turkey, elk and even wild boar.

Reedyâs had made it. The companyâs historical growth was so spectacular that no one could have predicted it. However, securities analysts speculated that Reedyâs could not keep up the pace. They warned that competition is fierce in the archery and hunting retail sales industry and that the firm might encounter little or no growth in the future. They estimated that stockholders also should expect no growth in future dividends.

Contrary to the conservative securities analysts, Mathew Reedy feels that the company could maintain a constant annual growth rate in dividends per share of 9.5% in the future, or possibly 13% for the next 2 years and 9.5% thereafter. Reedy based his estimates on an established long-term expansion plan into other states, Canadian and Mexican markets. Venturing into these markets was expected to cause the risk of the firm, as measured by the beta on its stock, to increase immediately from 1.1 to 1.5.

In preparing the long-term financial plan, Reedyâs chief financial officer, Eric Disbrow, has assigned a junior financial analyst, Chris Reed, to evaluate the firmâs current stock price. He has asked Chris to consider the conservative predictions of the securities analysts and the aggressive predictions of the company founder, Mathew Reedy.

Eric has compiled the 2015 financial data to aid his analysis:

| Data item | 2015 value | |

| Earnings per share (EPS) | $4.13 | |

| Price per share of common stock | $39.00 | |

| Book value of common stock equity | $6,000,000 | |

| Total common shares outstanding | 300,000 | |

| Common stock dividend per share | $2.05 | |

| Data Points | ||

| Beta, b | Required Return, K | |

| 0 | 4.5% | |

| .25 | 6.75% | |

| .5 | 9% | |

| .75 | 11.25% | |

| 1 | 13.5% | |

| 1.25 | 15.75% | |

| 1.5 | 18% | |

To Do

a. What is the firmâs current book value per share?

b. What is the firmâs current P/E ratio?

c. (1) What is the current required return for Reedy stock (use CAPM)?

(2) What will be the new required return for Reedy stock assuming that they expand into Canadian, Mexican and other state markets as planned (use CAPM)?

d. If the securities analysts are correct and there is no growth in future dividends, what will be the value per share of the Reedy stock? (Note: use the new required return on the companyâs stock here)

e. (1) If Mathew Reedyâs predictions are correct, what will be the value per share of Reedyâs stock if the firm maintains a constant annual 9.5% growth rate in future dividends? (Note: Continue to use the new required return here.)

(2) If Mathew Reedyâs predictions are correct, what will be the value per share of Reedyâs stock if the firm maintains a constant annual 13% growth rate in dividends per share over the next 2 years and 9.5% thereafter? (Note: Use the new required return here.)

f. Compare the current (2016) price of the stock and the stock values found in parts a, d, and e. Discuss why these values may differ. Which valuation method do you believe most clearly represents the true value of the Reedyâs stock?

PLEASE SHOW ALL WORK. THANK YOU.