prithivira92

Parul University

0 Followers

1 Following

2 Helped

prithivira92Lv3

9 Jul 2023

Answer: Velocity

prithivira92Lv3

23 Jun 2023

Answer:1. It is challenging to determine the exact current conflict with the b...

prithivira92Lv3

23 Jun 2023

Answer:To determine the horizontal and vertical components of the force exerte...

prithivira92Lv3

23 Jun 2023

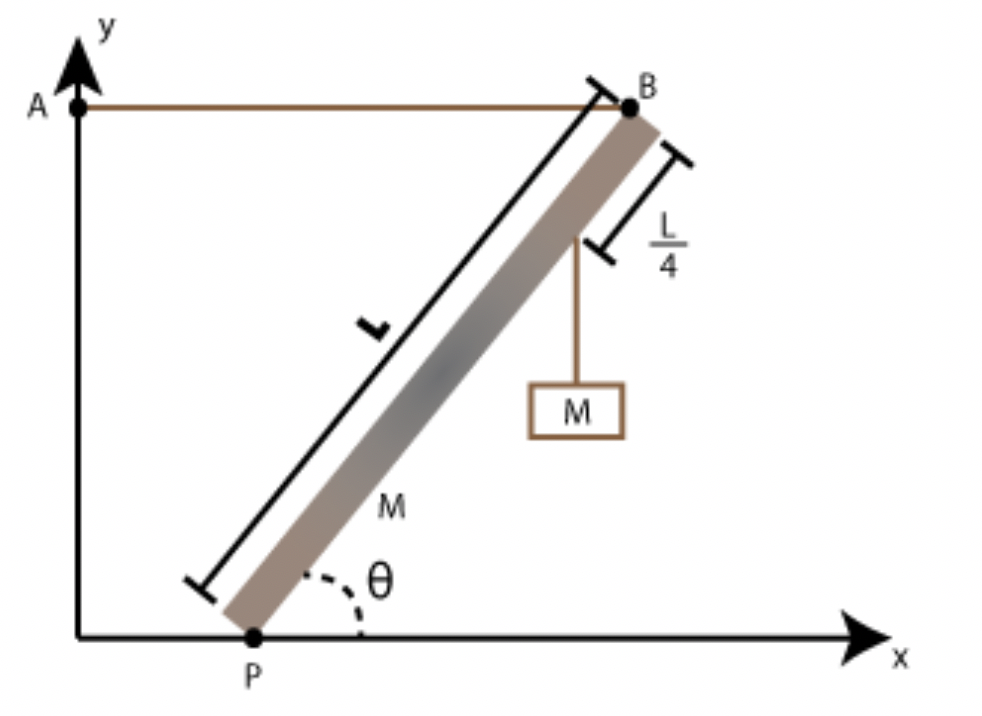

Answer:(a) To write an expression for the tension T in the horizontal cable AB...

prithivira92Lv3

23 Jun 2023

Answer:(a) To write an expression for the tension T in the horizontal cable AB...

prithivira92Lv3

23 Jun 2023

Answer:(c) To write an expression for the x-component Pr of the force exerted ...

prithivira92Lv3

23 Jun 2023

Answer: Step-by-step explanation:(a) To find an expression for the distance d ...

prithivira92Lv3

22 Jun 2023

Answer: Step-by-step explanation:To my knowledge, there is no specific animal ...

prithivira92Lv3

10 Jun 2023

Answer: The false statement about the properties of water is: b) When ionic co...

prithivira92Lv3

25 May 2023

Answer:Indeed, in today's interconnected world, cultural exchange is a common ...

prithivira92Lv3

25 May 2023

Answer:Based on the given options, the correct answer is:e) All of the AboveTh...

prithivira92Lv3

25 May 2023

Answer:The volcanism at Yellowstone National Park is primarily attributed to a...

prithivira92Lv3

25 May 2023

Answer:The slowly increasing distance between South America and Africa is prim...

prithivira92Lv3

25 May 2023

Answer:To meet the given requirements for the SD-WAN architecture design, the ...

prithivira92Lv3

25 May 2023

Answer:To mitigate the risk of data loss in the given scenario, the security t...

prithivira92Lv3

25 May 2023

Answer: for the given expression:∫[sqrt(x^3 + 1)] dx from √y to 1 dy, where y ...

prithivira92Lv3

25 May 2023

Answer:1. G. Fiscal Policy2. B. Net exports are equal to zero.3. I. Relationsh...

prithivira92Lv3

25 May 2023

Answer:1. G. Fiscal Policy2. B. Balanced trade3. I. Aggregate Expenditure Mode...

prithivira92Lv3

24 May 2023

Answer:1. Two strategies that firms in other industries might use to reduce co...

prithivira92Lv3

24 May 2023

Answer: Step-by-step explanation:D. GDP equals the sum of consumption, investm...

prithivira92Lv3

24 May 2023

Answer:Here are the corrections to your answers:1. C. Consumption, investment,...

prithivira92Lv3

24 May 2023

Answer:The correct answer is: The standard error of a regression coefficient m...

prithivira92Lv3

24 May 2023

Answer:The correct answer is: It is the value of the coefficient estimate divi...

prithivira92Lv3

24 May 2023

Answer:The correct answer is D. R2 statistic; 1.0.The R2 statistic, also known...

prithivira92Lv3

24 May 2023

Answer:The correct answers are:1. It measures the proportion of the variation ...

prithivira92Lv3

24 May 2023

Answer:To test the overall explanatory power of a regression equation, one com...

prithivira92Lv3

24 May 2023

Answer:The standard error of the regression is a statistical measure that quan...

prithivira92Lv3

24 May 2023

Answer:1. Assumption of the classical linear regression model:- The sample mea...

prithivira92Lv3

24 May 2023

Answer: Step-by-step explanation:1. Assumption of the classical linear regress...

prithivira92Lv3

24 May 2023

Answer:1) G) Fiscal Policy2) B) Balanced trade3) I) Aggregate Expenditure Mode...

prithivira92Lv3

24 May 2023

Answer: The correct answer is: c. as more of a good or service is consumed, th...

prithivira92Lv3

24 May 2023

Answer:To find the hydroxide ion concentration ([OH-]) in a solution of hydroi...

prithivira92Lv3

24 May 2023

Answer: Step-by-step explanation: Certainly! Here's a brief historical backgro...

prithivira92Lv3

24 May 2023

Answer: Step-by-step explanation:Human Resource Management (HRM) in Ethiopia h...

prithivira92Lv3

24 May 2023

Answer: Step-by-step explanation: Human Resources (HR) refers to the managemen...

prithivira92Lv3

24 May 2023

Answer:a) To find an expression for the electron's final speed V1 in terms of ...

prithivira92Lv3

16 May 2023

Answer: The correct option is: b) Adenine, cytosine, guanine, and uracil

prithivira92Lv3

16 May 2023

Answer: To determine whether the displayed segment is part of a DNA or RNA mol...

prithivira92Lv3

16 May 2023

Answer: To find the measure of angle SRV, we can make use of the properties of...

prithivira92Lv3

16 May 2023

Answer: Step-by-step explanation: To determine the empirical formula of the co...

A beam of mass m is angled up and to the right at an angle of 𝜃 above the horizontal ground. The beam is attached at its lower end to a pivot that allows it to rotate about an axis that points out of the page. The right side of a spring labeled k is attached to the free end of the beam, and the spring extends leftward, fixed to a vertical wall at its left end.

(a) Find an expression for the distance d the spring is stretched from equilibrium. (Use any variable or symbol stated above along with the following as necessary: k and g.)

A beam of mass m is angled up and to the right at an angle of 𝜃 above the horizontal ground. The beam is attached at its lower end to a pivot that allows it to rotate about an axis that points out of the page. The right side of a spring labeled k is attached to the free end of the beam, and the spring extends leftward, fixed to a vertical wall at its left end.

(a) Find an expression for the distance d the spring is stretched from equilibrium. (Use any variable or symbol stated above along with the following as necessary: k and g.)