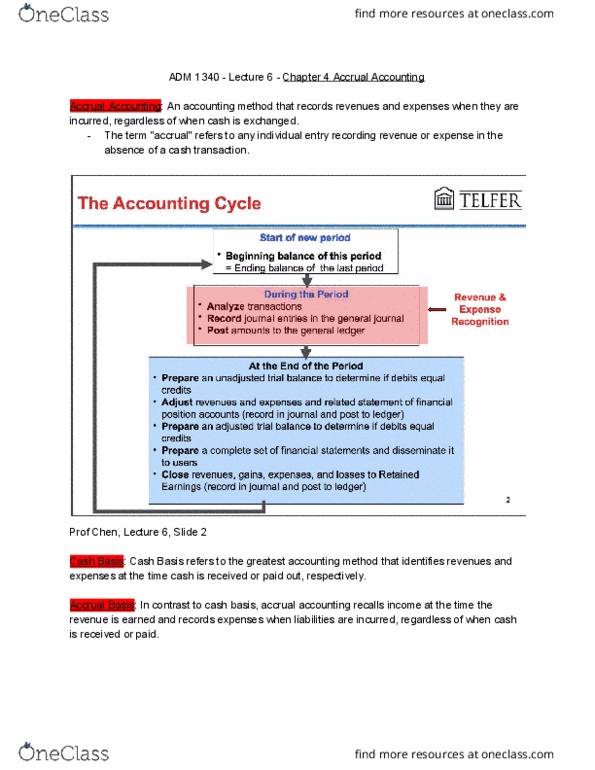

1. Which of the following identifies the proper order of theaccounting cycle?

A. Analyze, Journalize, Unadjusted Trial Balance

B. Analyze, Post, Unadjusted Trial Balance

C. Journalize, Post, Adjusted Trial Balance

D. Unadjusted Trial Balance, Adjusted Trial Balance, Close

E. Adjusted Trial Balance, Adjustments, Financial Statements

2. Interim financial statements refer to financial reports:

A. That cover less than one year, usually spanning one, three orsix-month periods

B. That are prepared before any adjustments have beenrecorded

C. That show the assets above the liabilities and theliabilities above the equity

D. Where revenues are reported on the income statement when cashis received and expenses are reported when cash is paid

E. Where the adjustment process is used to assign revenues tothe periods in which they are earned and to match expenses withrevenues

3. The accounting principle that requires revenue to be reportedwhen earned is the:

A. Matching principle

B. Revenue recognition principle

C. Time period principle

D. Accrual reporting principle

E. Going-concern principle

4. Adjusting entries:

A. Affect only income statement accounts

B. Affect only balance sheet accounts

C. Affect both income statement and balance sheet accounts

D. Affect only cash flow statement accounts

E. Affect only equity accounts

5. The system of preparing financial statements based onrecognizing revenues when the cash is received and reportingexpenses when the cash is paid is called:

A. Accrual basis accounting

B. Operating cycle accounting

C. Cash basis accounting

D. Revenue recognition accounting

E. Current basis accounting

6. If throughout an accounting period the fees for legalservices paid in advance by clients are recorded in an accountcalled Unearned Legal Fees, the end-of-period adjusting entry torecord the portion of those fees that has been earned is:

A. Debit Cash and credit Legal Fees Earned

B. Debit Cash and credit Unearned Legal Fees

C. Debit Unearned Legal Fees and credit Legal Fees Earned

D. Debit Legal Fees Earned and credit Unearned Legal Fees

E. Debit Unearned Legal Fees and credit Accounts Receivable

7. A company had no office supplies available at the beginningof the year. During the year, the company purchased $250 worth ofoffice supplies. On December 31, $75 worth of office suppliesremained. How much should the company report as office suppliesexpense for the year? A. $75 B. $125 C. $175 D. $250 E. $325 8. OnJanuary 1 a company purchased a five-year insurance policy for$1,800 with coverage starting immediately. If the purchase wasrecorded in the Prepaid Insurance account and the company recordsadjustments only at year-end, the adjusting entry at the end of thefirst year is:

A. Debit Prepaid Insurance, $1,800; credit Cash, $1,800

B. Debit Prepaid Insurance, $1,440; credit Insurance Expense,$1,440

C. Debit Prepaid Insurance, $360; credit Insurance Expense,$360

D. Debit Insurance Expense, $360; credit Prepaid Insurance,$360

E. Debit Insurance Expense, $360; credit Prepaid Insurance,$1,440

9. Unearned revenue is reported on the financial statementsas:

A. A revenue on the balance sheet

B. A liability on the balance sheet

C. An unearned revenue on the income statement

D. An asset on the balance sheet

E. An operating activity on the statement of cash flows

10. Which of the following assets is not depreciated?

A. Store fixtures

B. Computers

C. Land

D. Buildings

E. Vehicles

11. On April 30, 2011, a three-year insurance policy waspurchased for $18,000 with coverage to begin immediately. What isthe amount of insurance expense that would appear on the company'sincome statement for the year ended December 31, 2011? A. $500 B.$4,000 C. $6,000 D. $14,000 E. $18,000 12. Expenses incurred butunpaid that are recorded during the adjusting process with a debitto an expense and a credit to a liability are:

A. Intangible expenses

B. Prepaid expenses

C. Unearned expenses

D. Net expenses

E. Accrued expenses

13 The difference between the cost of an asset and theaccumulated depreciation for that asset is called

A. Depreciation Expense

B. Unearned Depreciation

C. Prepaid Depreciation

D. Depreciation Value

E. Book Value

14. A company purchased a new truck at a cost of $42,000 on July1, 2011. The truck is estimated to have a useful life of 6 yearsand a salvage value of $3,000. How much depreciation expense willbe recorded for the truck for the year ended December 31, 2011?

A. $3,250

B. $3,500

C. $4,000

D. $6,500

E. $7,000

15. A company's Office Supplies account shows a beginningbalance of $600 and an ending balance of $400. If office suppliesexpense for the year is $3,100, what amount of office supplies waspurchased during the period?

A. $2,700

B. $2,900

C. $3,300

D. $3,500

E. $3,700