ADM 1340 Lecture Notes - Lecture 1: Legal Personality, Financial Statement, International Financial Reporting Standards

ADM 1340 verified notes

1/11View all

Document Summary

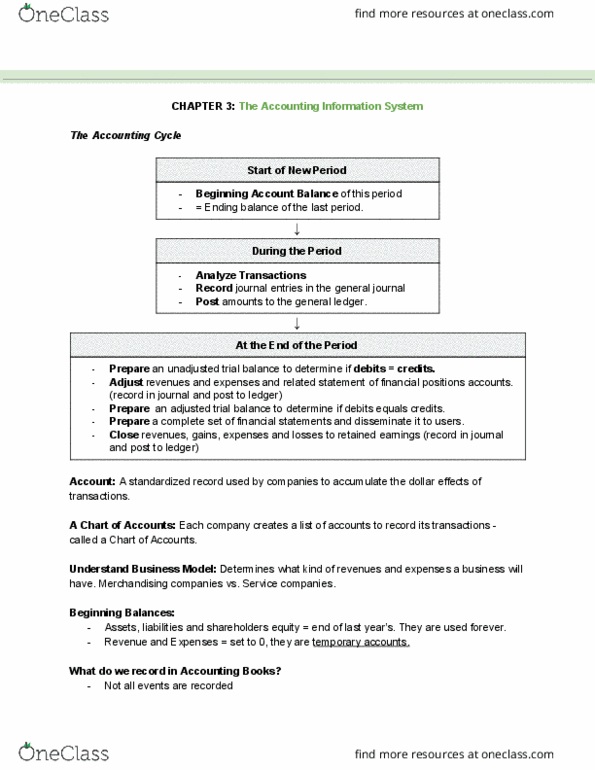

Chapter 1: purpose and use of financial statements. Financial accounting: a system that identifies, records and communicates. Contains financial statements that eventually goes to external decision makers. Financial statements include: statement of income, statement of changes in shareholder equity, statement of financial position (balance sheet, statement of cash flows, notes to financial statements. Simple to set up; owner has control over the business; limited life, unlimited liability. Partnership: owned and operated by two or more people. Formalized in written agreement, not taxed as separate entities, limited life, each partner has unlimited liability. Indefinite life, shareholders enjoy limited liability; ease of raising capital. Entity perspective in accounting: the assets of the company belong to the company, not a specific creditor/shareholder. Generally accepted accounting principles (gaap): includes broad policies and practices as well as rules and procedures that have substantial authoritative support and agreement about how to record and report economic events. Chartered professional accounts canada handbook (ie. cpa canada handbook):