ADM 1340 Lecture 11: ADM 1340 - Lecture 11 - Reporting & Analyzing Inventory

Document Summary

Get access

Related Documents

Related Questions

All questions have to do with cost accounting systems,more in particular, process cost systems.

Complete each of the following statements by writing theappropriate words or amounts in the answers blanks.

1-5. Identify whether the process cost or job order cost systemwould be more appropriate for each of the followingbusinesses:

1. accounting firm 1. ____

2. breakfast cereal manufacturer 2. ____

3. ship construction 3. ____

4. pharmaceuticals company 4. ____

5. computer chip manufacturer 5. ____

6. The number of units that could have been completed within agiven accounting period with respect to direct materials andconversion costs is the 6. ____

7. Direct labor and factory overhead are referred to as 7.____

8â9. Oslo Manufacturing incurred $72,000 of direct materialscosts, direct labor costs of $24,500, and factory overhead of$20,500. If 1,000 direct materials equivalent units and 900conversion equivalent units were manufactured, then:

8. The equivalent unit cost for direct materials is 8. $____

9. The equivalent unit cost for conversion is 9. $____

10. The periodic report prepared for each processing department,summarizing (1) the units for which the department is responsibleand their disposition and (2) the costs charged the department andtheir allocation, is termed the 10. ____

11. The method of inventory costing that assumes the unitproduct costs should be determined separately for each period inthe order in which the costs were incurred is 11. ____

12â15. In a process cost system, the cost of goods completed andthe ending inventory valuation are determined by using thefollowing four steps:

12. ____

13. ____

14. ____

15. ____

16â17. The transferred costs of completed production inDepartment A using a process cost system include:

16. ____

17. ____

18â20. The three categories of units to be assigned cost for anaccounting period in a process cost system are:

18. ____

19. ____

20. ____

21â24. Department W had 8,000 units in work in process that were30% converted at the beginning of the period at a cost of $16,400.During the period, 15,000 units of direct materials were added at acost of $48,000, 16,000 units were completed, and 7,000 units were40% completed. The first-in, first-out cost method is used and allmaterials are added at the beginning of the process. Direct laborwas $30,000, and factory overhead was $54,000 during theperiod.

21. The number of equivalent units of conversion for the period was21. ____

22. The total conversion costs for the period were 22. $____

23. The conversion cost of the units started and completed duringthe period was 23. $____

24. The conversion cost of the 7,000 units in process at the end ofthe period was 24. $____

Indicate the titles of the accounts to be debited and creditedin recording the selected transactions given below by inserting theletter or letters of the account titles listed in the appropriatecolumns. (Do not record the amounts.)

ACCOUNTS

A. Accounts Payable E. FactoryOverheadâDepartment A I. Sales

B. Accounts Receivable F.Factory OverheadâDepartment B J. Wages Payable

C. Cash G. Finished GoodsK. Work in ProcessâDepartment A

D. Cost of Goods Sold H.Materials L. Work inProcessâDepartment B

TRANSACTIONS | Debit | Credit | ||

0. Paid cash for wages owed, $47,000............................................................. | J | 0. ____ | C | 0. ____ |

1-2. Materials requisitioned for use in Department A,$36,000, of which $31,500 entered directly into the product..................................................... |

|

| ||

3-4. Labor in Department A, $13,000, was used directlyin the manufacture of the product..................................................................................................... |

|

| ||

5-6. Factory overhead applied to production inDepartment A, $6 per machine hour..................................................................................................... |

|

| ||

| 7-8. Goods finished in Department A and transferred toDepartment B, $79,000............................................................................................................... |

|

| ||

9-10. Goodsfinished in Department B and transferred to finished goods,$114,000............................................................................................................. |

|

| ||

11-12. Cost of finishedgoods sold, $126,374......................................................... | 11. ____ | 12. ____ |

| Answers to the 30multiple choice questions | 2 points each, 30questions, for 60 point total | ||||||||||

| 60 points | |||||||||||

| < please record | 1) | From an internal control standpoint, the asset mostsusceptible to improper diversion and use is | |||||||||

| answer here | a. | prepaid insurance. | |||||||||

| b. | cash. | ||||||||||

| c. | Equipment | ||||||||||

| d. | Investments | ||||||||||

| 2) | Jolene is warehouse custodian and alsomaintains the accounting record of the inventory held at thewarehouse. An assessment of this situation indicates | ||||||||||

| a. | documentation procedures are violated. | ||||||||||

| b. | independent internal verification is violated. | ||||||||||

| c. | segregation of duties is violated. | ||||||||||

| < please record | d. | establishment of responsibility is violated. | |||||||||

| answer here | |||||||||||

| 3) | Internal control is defined, in part, as a planthat safeguards | ||||||||||

| a. | all balance sheet accounts. | ||||||||||

| b. | assets. | ||||||||||

| c. | liabilities. | ||||||||||

| d. | capital stock. | ||||||||||

| 4) | The control principle related to nothaving the same person authorize and pay for goods is known as | ||||||||||

| a. | establishment of responsibility. | ||||||||||

| b. | independent internal verification. | ||||||||||

| < please record | c. | segregation of duties. | |||||||||

| answer here | d. | rotation of duties. | |||||||||

| 5) | Two individuals at a retail store work thesame cash register. You evaluate this situation as | ||||||||||

| a. | a violation of establishment of responsibility. | ||||||||||

| b. | a violation of segregation of duties. | ||||||||||

| c. | supporting the establishment of responsibility. | ||||||||||

| < please record | d. | supporting internal independent verification. | |||||||||

| answer here | |||||||||||

| 6) | Having different individuals receive cash,record cash receipts, and hold the cash is an example of | ||||||||||

| a. | establishment of responsibility. | ||||||||||

| b. | segregation of duties. | ||||||||||

| c. | documentation procedures. | ||||||||||

| d. | independent internal verification. | ||||||||||

| 7) | An adjusting entry is not required for | ||||||||||

| a. | outstanding checks. | ||||||||||

| b. | collection of a note by the bank. | ||||||||||

| c. | NSF checks. | ||||||||||

| d. | bank service charges. | ||||||||||

| 8) | If a check correctly written and paid bythe bank for $591 is incorrectly recorded on the company's booksfor $519, | ||||||||||

| the appropriate treatment on the bankreconciliation would be to | |||||||||||

| a. | deduct $72 from the book's balance. | ||||||||||

| b. | add $72 to the book's balance. | ||||||||||

| c. | deduct $72 from the bank's balance. | ||||||||||

| d. | deduct $591 from the book's balance. | ||||||||||

| 9) | During 2013, Parker Enterprises generatedrevenues of $60,000. The company's expenses were as follows: | ||||||||||

| cost of goods sold of $30,000, operatingexpenses of $12,000 and a loss on the sale of equipment of$2,000. | |||||||||||

| Parker's gross profit is: | |||||||||||

| a. | $16,000.00 | ||||||||||

| b. | $18,000.00 | ||||||||||

| c. | $30,000.00 | ||||||||||

| d. | $60,000.00 | ||||||||||

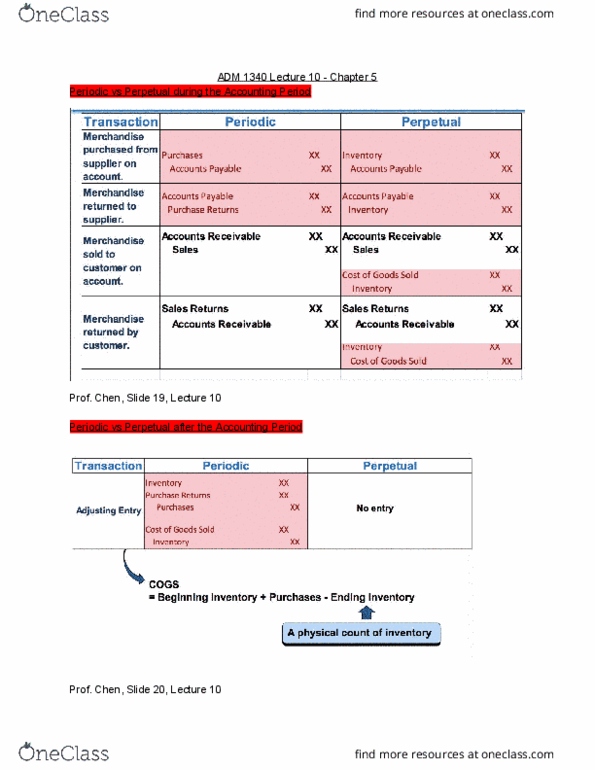

| 10) | A primary difference between a periodicand perpetual inventory system is that a periodic system: | ||||||||||

| a. | determines the inventory on hand only at the end ofthe accounting period. | ||||||||||

| b. | provides better control over inventories. | ||||||||||

| c. | records the cost of goods sold after each saletransaction. | ||||||||||

| d. | keeps a record showing the merchandise inventory onhand at all times. | ||||||||||

| 11) | A decline in a company's gross profitcould be caused by all of the following except: | ||||||||||

| a. | selling products using a lower markup. | ||||||||||

| b. | clearance of discontinued inventory. | ||||||||||

| c. | paying lower prices to its suppliers. | ||||||||||

| d. | increasing competition resulting in a lower sellingprice. | ||||||||||

| 12) | South Company uses the perpetual inventorysystem. South's goods in transit at December 31 include: | ||||||||||

| Sales made by South | Purchases made by South | ||||||||||

| (1) FOB destination | (3) FOB destination | ||||||||||

| (2) FOB shipping point | (4) FOB shipping point | ||||||||||

| Which itemsshould be included in South's inventory at December 31? | |||||||||||

| a. (2) and (3) | |||||||||||

| b. (1) and (4) | |||||||||||

| c. (1) and (3) | |||||||||||

| d. (2) and (4) | |||||||||||

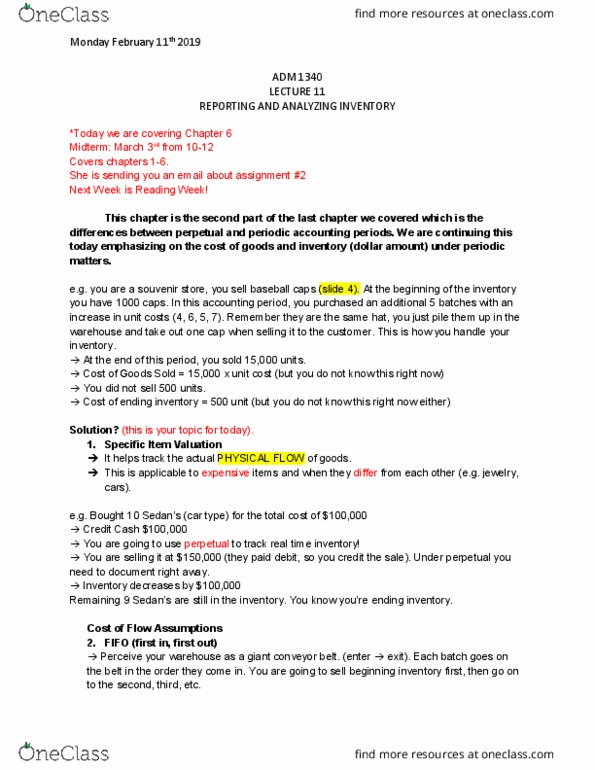

| 13) | In periods of rising prices, the inventorymethod which results in the greatest net income is the: | ||||||||||

| a. | LIFO method. | ||||||||||

| b. | FIFO method. | ||||||||||

| c. | Weighted Average method. | ||||||||||

| d. | Lower of Cost or Market method. | ||||||||||

| 14) | The following information was available for RawleyCompany at December 31, 2008: | ||||||||||

| inventory (Jan .01) $80,000; inventory (Dec. 31)$120,000; cost of goods sold $600,000; | |||||||||||

| accounts receivable $73,000; and sales$900,000. | |||||||||||

| Rawley's inventory turnover in 2008 was: | |||||||||||

| a. | 9.00 times. | ||||||||||

| b. | 7.50 times. | ||||||||||

| c. | 6.00 times. | ||||||||||

| d. | 5.00 times. | ||||||||||

| 15) | A petty cash fund of $200 is replenishedwhen the fund contains $5 in cash and receipts for $193. | ||||||||||

| The entry to replenish the fund would: | |||||||||||

| a. | credit Cash Over and Short for $2. | ||||||||||

| b. | credit Miscellaneous Revenue for $2. | ||||||||||

| c. | debit Cash Over and Short for $2. | ||||||||||

| d. | debit Miscellaneous Expense for $2. | ||||||||||

| 16) | An item is considered material if | ||||||||||

| a. | it doesn't costs a lot of money. | ||||||||||

| b. | it is of a tangible good intended for re-sale. | ||||||||||

| c. | it is likely to influence the decision of aninvestor or creditor. | ||||||||||

| d. | the cost of reporting the item is greater than itsbenefits. | ||||||||||

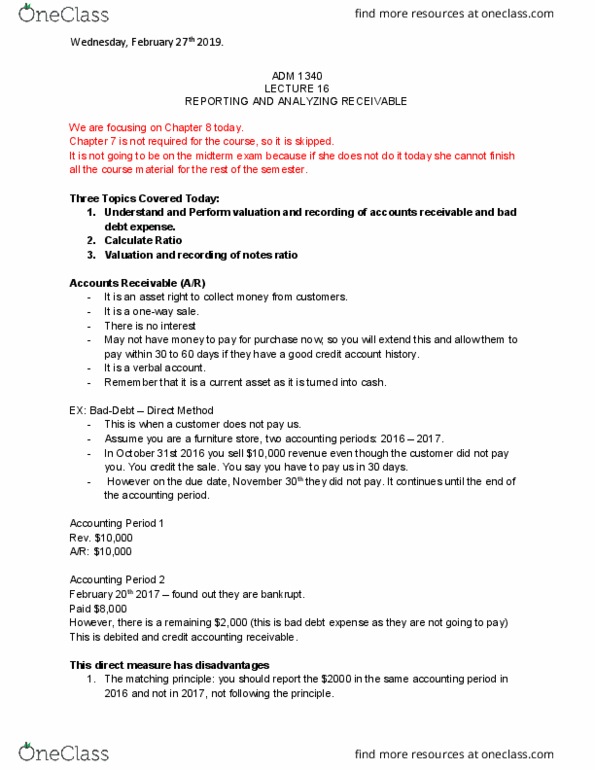

| 17) | Receivables might be sold to | ||||||||||

| a. lengthen the cash-to-cash operating cycle. | |||||||||||

| b take advantage of deep discounts on the cashrealizable value of receivables. | |||||||||||

| c. generate cash quickly. | |||||||||||

| d. finance companies at an amount greater than cashrealizable value. | |||||||||||

| 18) | If the amount of uncollectible accountexpense is understated at year end: | ||||||||||

| a. | net income will be understated. | ||||||||||

| b. | stockholders' equity will be understated. | ||||||||||

| c. | allowance for doubtful accounts will be overstated. | ||||||||||

| d. | net accounts receivable will be overstated. | ||||||||||

| 19) | A debit balance in the Allowance for DoubtfulAccounts | ||||||||||

| a. | is the normal balance for that account. | ||||||||||

| b. | indicates that actual bad debt write-offs haveexceeded previous provisions for bad debts. | ||||||||||

| c. | indicates that actual bad debt write-offs have beenless than what was estimated. | ||||||||||

| d. | cannot occur if the percentage of sales method ofestimating bad debts is used. | ||||||||||

| 20) | Bad Debts Expense is considered | ||||||||||

| a. | an avoidable cost in doing business on a credit basis. | ||||||||||

| b. | an internal control weakness. | ||||||||||

| c. | a necessary risk of doing business on a credit basis. | ||||||||||

| d. | avoidable unless there is a recession. | ||||||||||

| 21) | The best managed companies will have | ||||||||||

| a. | no uncollectible accounts. | ||||||||||

| b. | a very strict credit policy. | ||||||||||

| c. | a very lenient credit policy. | ||||||||||

| d. | some accounts that will prove to be uncollectible. | ||||||||||

| 22) | Two methods of accounting for uncollectibleaccounts are the | ||||||||||

| a. | allowance method and the accrual method. | ||||||||||

| b. | allowance method and the net realizable method. | ||||||||||

| c. | direct write-off method and the accrual method. | ||||||||||

| d. | direct write-off method and the allowance method. | ||||||||||

| 23) | When the allowance method of accountingfor uncollectible accounts is used, Bad Debts Expense isrecorded | ||||||||||

| a. | in the year after the credit sale is made. | ||||||||||

| b. | in the same year as the credit sale. | ||||||||||

| c. | as each credit sale is made. | ||||||||||

| d. | when an account is written off as uncollectible. | ||||||||||

| 24) | Allowance for Doubtful Accounts on the balancesheet | ||||||||||

| a. | is offset against total current assets. | ||||||||||

| b. | increases the cash realizable value of accountsreceivable. | ||||||||||

| c. | appears under the heading "Other Assets." | ||||||||||

| d. | is offset against accounts receivable. | ||||||||||

| 25) | In reviewing the accounts receivable, thecash realizable value is $14,000 before the write-off of a $1,500account. | ||||||||||

| What is the cash realizable value after thewrite-off? | |||||||||||

| a. | $1,500 | ||||||||||

| b. | $12,500 | ||||||||||

| c. | $14,000 | ||||||||||

| d. | $15,500 | ||||||||||

| 26) | The maturity value of a $60,000, 10%, 60-day notereceivable dated July 3 is | ||||||||||

| a. | $60,000 | ||||||||||

| b. | $61,000 | ||||||||||

| c. | $66,000 | ||||||||||

| d. | $70,000 | ||||||||||

| 27) | The interest on a $10,000, 10%, 1-year notereceivable is | ||||||||||

| a. | $1,000 | ||||||||||

| b. | $10,000 | ||||||||||

| c. | $10,100 | ||||||||||

| d. | $11,000 | ||||||||||

| 28) | The maturity value of a $60,000, 8%, 3-month notereceivable is | ||||||||||

| a. | $60,400 | ||||||||||

| b. | $60,480 | ||||||||||

| c. | $61,200 | ||||||||||

| d. | $64,800 | ||||||||||

| 29) | Notes receivable are recorded in the accounts at | ||||||||||

| a. | cash (net) realizable value. | ||||||||||

| b. | face value. | ||||||||||

| c. | gross realizable value. | ||||||||||

| d. | maturity value. | ||||||||||

| 30) | Which of the following are also called tradereceivables? | ||||||||||

| a. | Accounts receivable | ||||||||||

| b. | Other receivables | ||||||||||

| c. | Advances to employees | ||||||||||

| d. | Income taxes refundable | ||||||||||