ECO 1102 Lecture Notes - Lecture 22: Systemic Risk, Efficient-Market Hypothesis

ECO 1102 verified notes

22/26View all

Document Summary

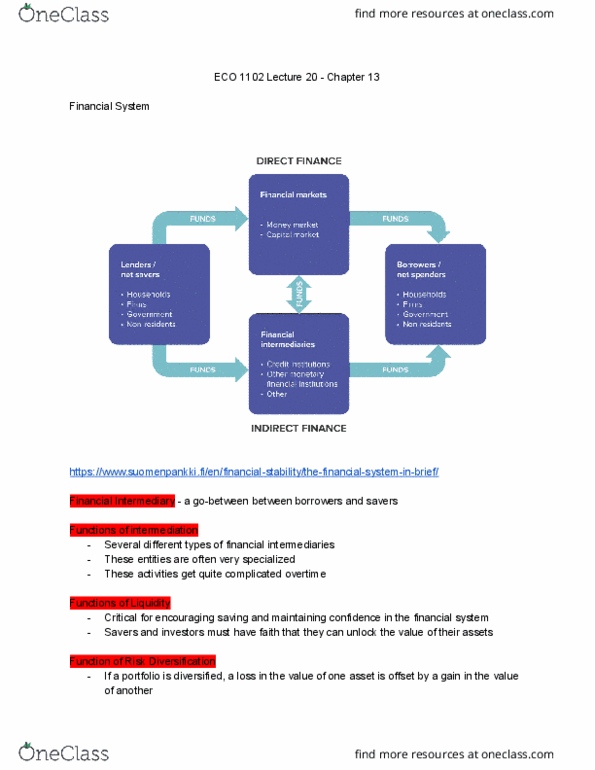

Eco 1102 lecture 20 - chapter 13 https://www. suomenpankki. fi/en/financial-stability/the-financial-system-in-brief/ Financial intermediary - a go-between between borrowers and savers. Critical for encouraging saving and maintaining confidence in the financial system. Savers and investors must have faith that they can unlock the value of their assets. If a portfolio is diversified, a loss in the value of one asset is offset by a gain in the value of another. Also, critical for saving and maintaining confidence in the financial system. The opposite of diversified risk is systemic risk. They pay dividends if the company is profitable. They pay capital gains (or losses) if stock value is more than the price you had paid for. It is risky for the purchaser because both payments are tremendously variable. They are greatly tradeable before the maturation date. Any financial asset whose value is derived from the value of some other assets.