ECON 201 Lecture Notes - Lecture 14: Fiscal Multiplier

ECON 201 verified notes

14/30View all

Document Summary

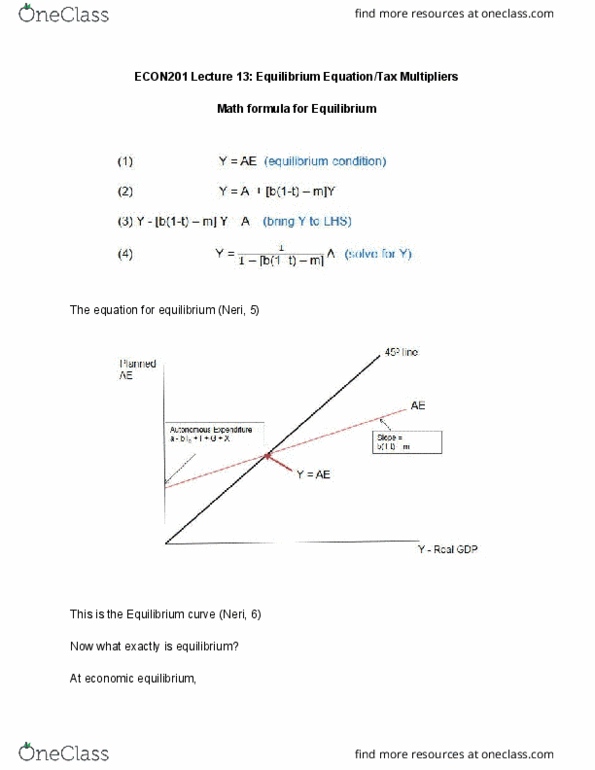

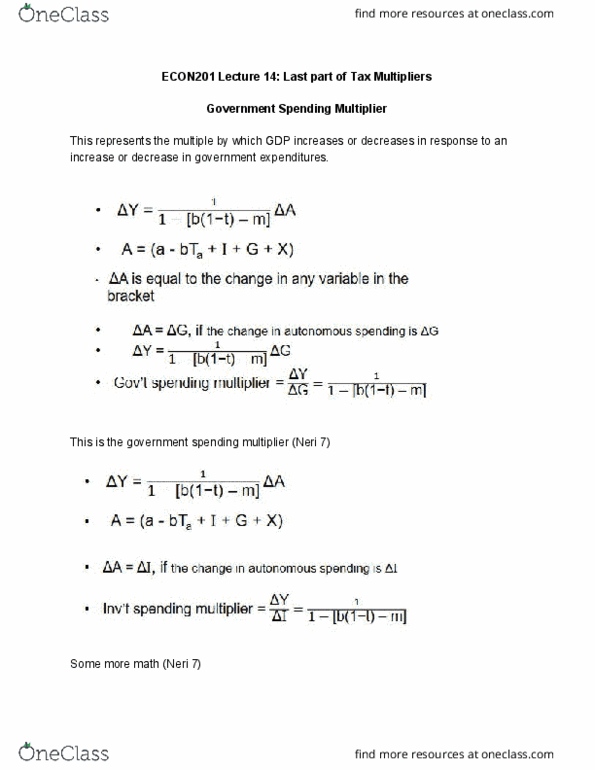

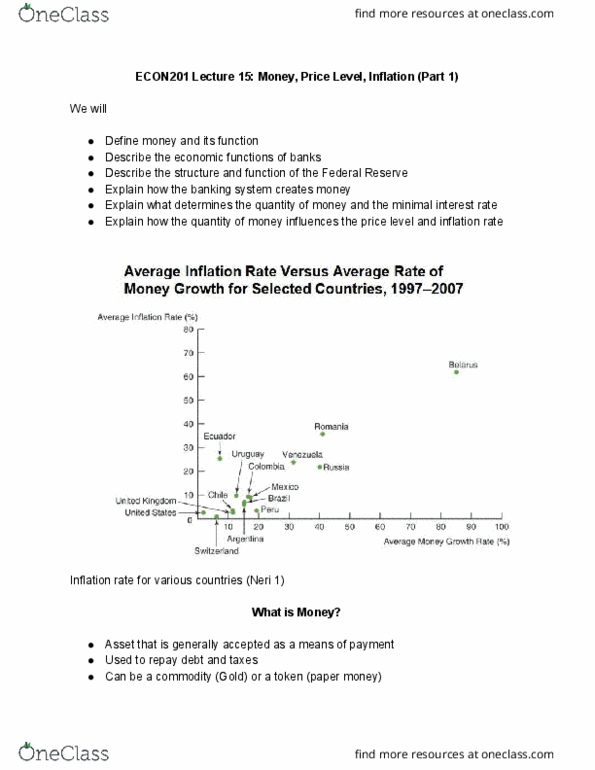

Econ201 lecture 14: last part of tax multipliers. This represents the multiple by which gdp increases or decreases in response to an increase or decrease in government expenditures. This is the government spending multiplier (neri 7) We can plot a on the graph to see the change in government spending multiplicity (neri. Expenditure describes the components of an economy"s aggregate expenditure that are not impacted by that same economy"s real level of income. This type of spending is considered automatic and necessary, whether occurring at the government level or the individual level. (investopedia) This is the equation to use to find the tax multiplier value (neri 8) And lastly we have the balanced budget multiplier. A balanced budget is when revenues is equal to expenditures. Thus there is no budget deficit nor surplus. Most economists agree a balanced budget is good for the economy in the long run.