MGMT 30A Lecture Notes - Lecture 21: Retained Earnings, Revenue Recognition, General Ledger

MGMT 30A verified notes

21/21View all

Document Summary

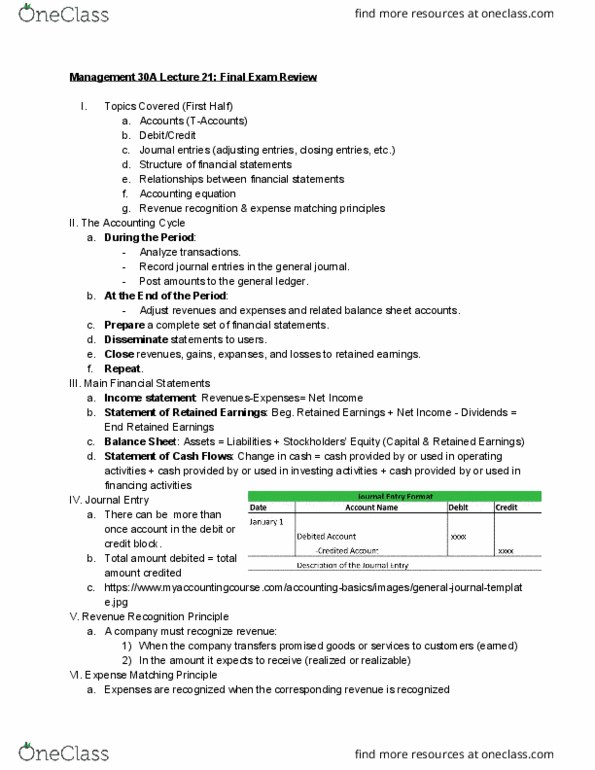

Topics covered (first half: accounts (t-accounts, debit/credit, journal entries (adjusting entries, closing entries, etc. , structure of financial statements, relationships between financial statements, accounting equation, revenue recognition & expense matching principles. Record journal entries in the general journal. Adjust revenues and expenses and related balance sheet accounts. Statements to users: at the end of the period , prepare , disseminate . Revenues, gains, expanses, and losses to retained earnings: close , repeat a, statement of retained earnings , balance shee , statement of cash flows . Retained earnings + net income - dividends = T: assets = liabilities + stockholders" equity (capital & retained earnings) activities + cash provided by or used in investing activities + cash provided by or used in financing activities. : change in cash = cash provided by or used in operating. In the amount it expects to receive (realized or realizable) Expense matching principle: expenses are recognized when the corresponding revenue is recognized.