ACCT 2001 Lecture Notes - Lecture 27: Current Liability, Financial Statement, Promissory Note

ACCT 2001 verified notes

27/30View all

Document Summary

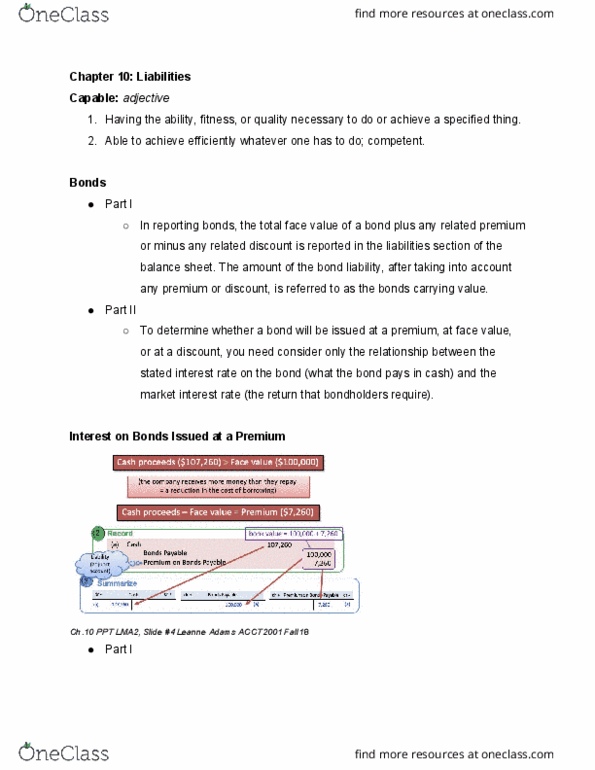

Liabilities play a significant role in financing most business activities. 2. obtains short-term loans to cover gaps in cash flows, 3. and issues long-term debt to obtain money for expanding into new regions and markets. To help financial statement users know when liabilities must be repaid, companies prepare a classified balance sheet. Current liabilities are defined as short-term obligations that will be paid with current assets within the company"s current operating cycle or within one year of the balance sheet date, whichever is longer. Learning objective 10-2: explain how to account for common types of current liabilities. Accounts payable is increased (credited) when a company receives goods or services on credit, and it is decreased (debited) when the company pays on its account. Accounts payable is generally interest free unless it becomes overdue. Accrued liabilities are liabilities that have been incurred but not yet paid. Many companies have a staff devoted totally to preparing payroll.