ECON 1201 Lecture Notes - Lecture 11: Payroll Tax, Deadweight Loss, Progressive Tax

ECON 1201 verified notes

11/30View all

Document Summary

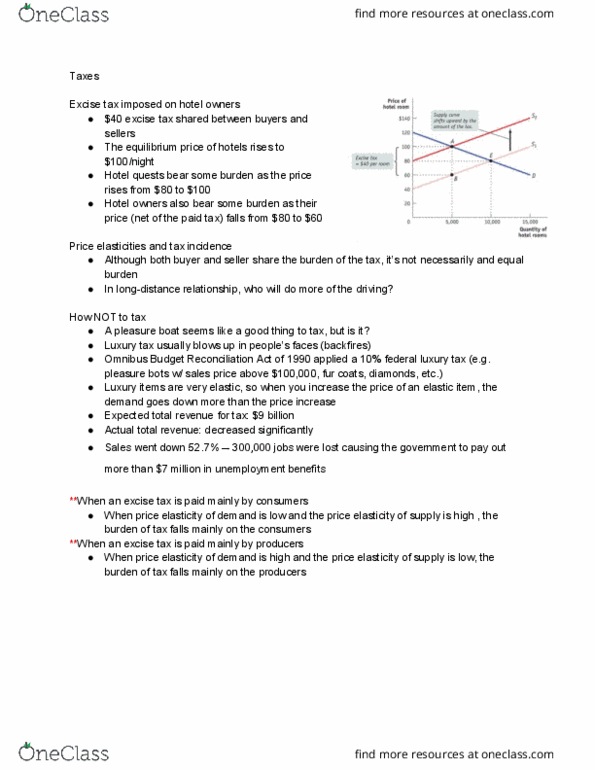

excise tax shared between buyers and sellers. The equilibrium price of hotels rises to. Hotel quests bear some burden as the price rises from to . Hotel owners also bear some burden as their price (net of the paid tax) falls from to . Although both buyer and seller share the burden of the tax, it"s not necessarily and equal burden. Luxury tax usually blows up in people"s faces (backfires) Omnibus budget reconciliation act of 1990 applied a 10% federal luxury tax (e. g. pleasure bots w/ sales price above ,000, fur coats, diamonds, etc. ) Luxury items are very elastic, so when you increase the price of an elastic item, the demand goes down more than the price increase. Expected total revenue for tax: billion. Sales went down 52. 7% 300,000 jobs were lost causing the government to pay out more than million in unemployment benefits. **when an excise tax is paid mainly by consumers.