MKT 4123 Lecture Notes - Lecture 9: Adobe Marketing Cloud, Google Analytics, Open Archives Initiative

Assignment 9: Abobe Analytics and Google Analytics

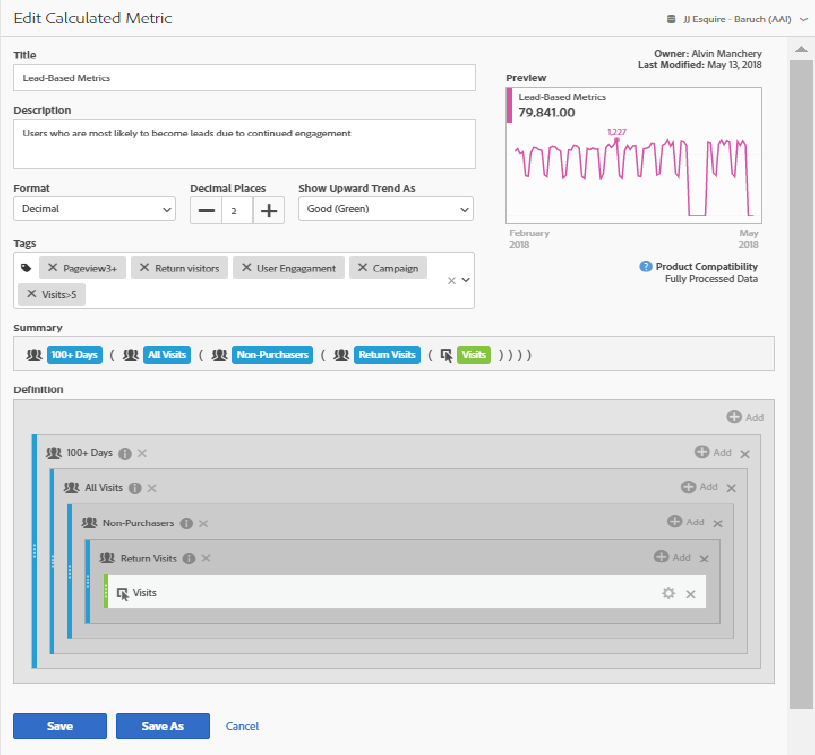

Calculated Metrics

Name: Alvin Manchery

Class: MKT 4123 FMA

ADOBE ANALYTICS

1. Using the JJ ESQUIRE BARUCH OAI Reporting Suite for the current time period, make

a “Calculated Metric”, name it, and describe it, below. Take a screenshot of the screen

where you created the custom metric and place it below.

2. What do you think your custom metric is useful for?

My custom metric (if made correctly) is useful for monitoring individuals that have not only

engaged with it, but for finding constant value with its content.

3. Run a report that contains a “breakdown” – take a screenshot and paste it below:

Unsure how to go about this.

4. What do you think the breakdown report you generated would be useful for?

Unsure how to go about this.

5. What type of filter would be most useful in generating the following report (hint, the

answer is in Lesson / Module 9)? – Most Popular Filter

Report that needs the filter:

GOOGLE ANALYTICS

Google Analytics supports Calculated Metrics IF the user has administrator privileges to the

profile. Here is a Google Help document that covers the subject of Calculated Metrics in more

detail. None the less, it appears student can view alculated Metrics in the DEMO account.

https://support.google.com/analytics/answer/6121409?hl=en

Also, refer to this video that covers how to configure Calculated Metrics

.https://www.youtube.com/watch?v=BL1HU3RbBPE